Accounting Debit Credit Cheat Sheet

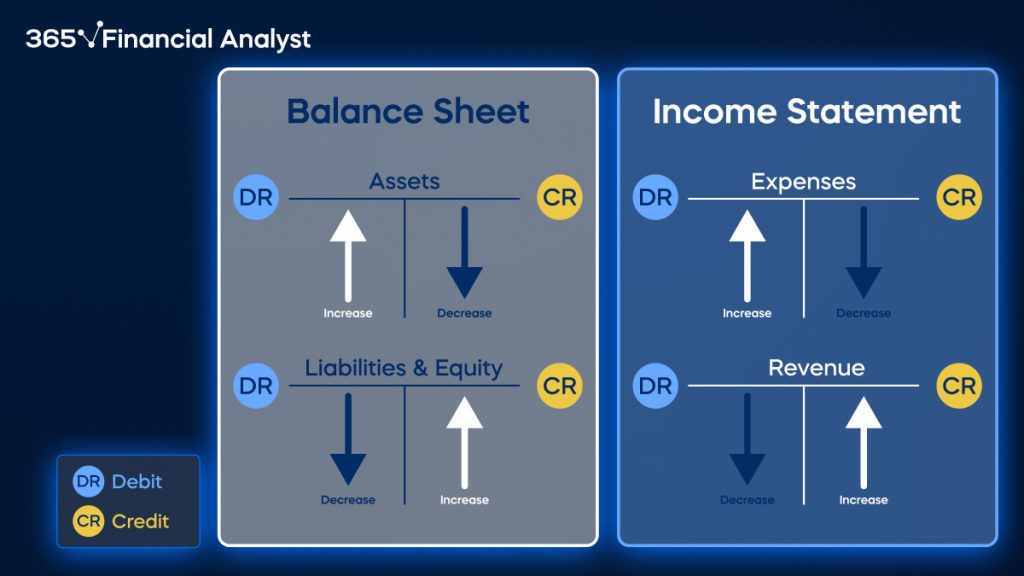

Accounting Debit Credit Cheat Sheet - They can increase or decrease different types of accounts: As a general rule, if a debit increases 1 type of account, a credit will decrease it. In accounting, debits and credits aren’t just about adding or subtracting cash. Debits and credits debit cash, credit asset, debit accumulated depreciation, debit loss on sale bonds financial instrument (agreement) issued by a company to borrow money from investors at. While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction occurs. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting. Use the cheat sheet in this article to get to grips with how credits and debits affect your accounts.

Use the cheat sheet in this article to get to grips with how credits and debits affect your accounts. Debits and credits debit cash, credit asset, debit accumulated depreciation, debit loss on sale bonds financial instrument (agreement) issued by a company to borrow money from investors at. While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction occurs. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting. As a general rule, if a debit increases 1 type of account, a credit will decrease it. They can increase or decrease different types of accounts: In accounting, debits and credits aren’t just about adding or subtracting cash.

While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction occurs. As a general rule, if a debit increases 1 type of account, a credit will decrease it. In accounting, debits and credits aren’t just about adding or subtracting cash. Debits and credits debit cash, credit asset, debit accumulated depreciation, debit loss on sale bonds financial instrument (agreement) issued by a company to borrow money from investors at. They can increase or decrease different types of accounts: Use the cheat sheet in this article to get to grips with how credits and debits affect your accounts. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting.

Debits and Credits Bookkeeping Basics

While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction occurs. They can increase or decrease different types of accounts: As a general rule, if a debit increases 1 type of account, a credit will decrease it. In accounting, debits and credits aren’t just.

Printable Financial Accounting Cheat Sheet

Use the cheat sheet in this article to get to grips with how credits and debits affect your accounts. They can increase or decrease different types of accounts: In accounting, debits and credits aren’t just about adding or subtracting cash. Debits and credits debit cash, credit asset, debit accumulated depreciation, debit loss on sale bonds financial instrument (agreement) issued by.

Accounting debit credit cheat sheet tagreti

They can increase or decrease different types of accounts: In accounting, debits and credits aren’t just about adding or subtracting cash. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting. While assets, liabilities and equity are types of accounts, debits.

Debits and Credits

In accounting, debits and credits aren’t just about adding or subtracting cash. Use the cheat sheet in this article to get to grips with how credits and debits affect your accounts. As a general rule, if a debit increases 1 type of account, a credit will decrease it. This article helps you grasp the concepts by walking you through the.

Debits and Credit Cheat Sheet Accounting education, Bookkeeping, Debit

Debits and credits debit cash, credit asset, debit accumulated depreciation, debit loss on sale bonds financial instrument (agreement) issued by a company to borrow money from investors at. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting. In accounting, debits.

Debit And Credit Cheat Sheet Tribuntech

As a general rule, if a debit increases 1 type of account, a credit will decrease it. In accounting, debits and credits aren’t just about adding or subtracting cash. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting. While assets,.

Looking Good Debit And Credit Sheet Balance Uber

This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting. While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction occurs. In accounting, debits and.

Unbelievable Debits And Credits Cheat Sheet Pdf Excel Balance

This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting. As a general rule, if a debit increases 1 type of account, a credit will decrease it. They can increase or decrease different types of accounts: Debits and credits debit cash,.

Debits and Credits Cheat Sheet 365 Financial Analyst

In accounting, debits and credits aren’t just about adding or subtracting cash. Debits and credits debit cash, credit asset, debit accumulated depreciation, debit loss on sale bonds financial instrument (agreement) issued by a company to borrow money from investors at. While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the.

9 best images about Accounting Class on Pinterest Legends, Dallas

Debits and credits debit cash, credit asset, debit accumulated depreciation, debit loss on sale bonds financial instrument (agreement) issued by a company to borrow money from investors at. In accounting, debits and credits aren’t just about adding or subtracting cash. Use the cheat sheet in this article to get to grips with how credits and debits affect your accounts. While.

In Accounting, Debits And Credits Aren’t Just About Adding Or Subtracting Cash.

Debits and credits debit cash, credit asset, debit accumulated depreciation, debit loss on sale bonds financial instrument (agreement) issued by a company to borrow money from investors at. This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting. Use the cheat sheet in this article to get to grips with how credits and debits affect your accounts. While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction occurs.

They Can Increase Or Decrease Different Types Of Accounts:

As a general rule, if a debit increases 1 type of account, a credit will decrease it.