Arizona Tax Exempt Form

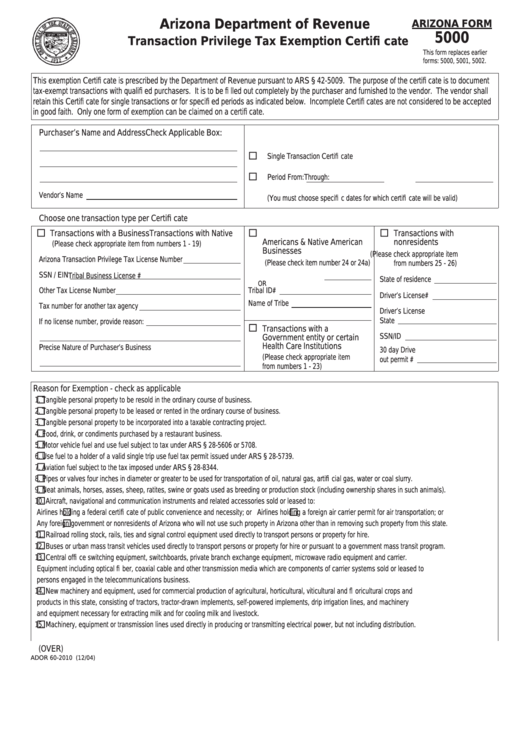

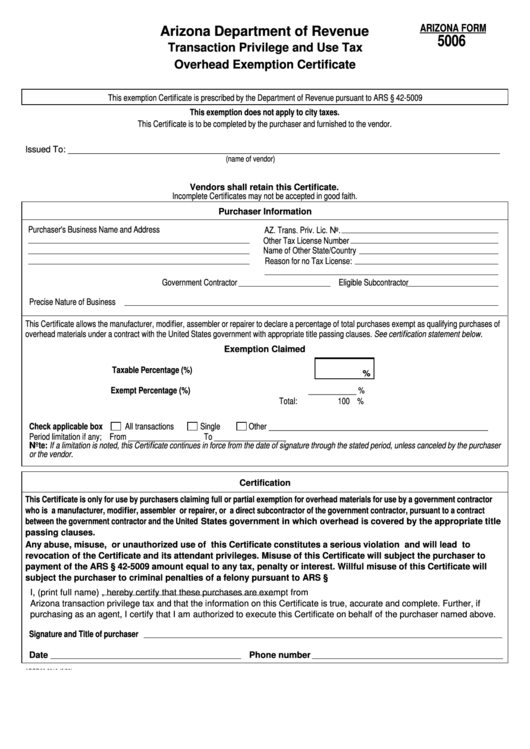

Arizona Tax Exempt Form - Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. To request that a purchase using another ars title code be exempt from sales tax. It must be filled out by the purchaser. This form is used to claim state and city tax exemptions or deductions for various transactions in arizona. Download form 5000 to claim state and city tax deductions or exemptions for transactions in arizona. This establishes a basis for state and city tax.

It must be filled out by the purchaser. Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before. Download form 5000 to claim state and city tax deductions or exemptions for transactions in arizona. This form is used to claim state and city tax exemptions or deductions for various transactions in arizona. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. This establishes a basis for state and city tax. To request that a purchase using another ars title code be exempt from sales tax.

To request that a purchase using another ars title code be exempt from sales tax. Download form 5000 to claim state and city tax deductions or exemptions for transactions in arizona. This establishes a basis for state and city tax. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. This form is used to claim state and city tax exemptions or deductions for various transactions in arizona. It must be filled out by the purchaser. Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before.

Downloads

This form is used to claim state and city tax exemptions or deductions for various transactions in arizona. This establishes a basis for state and city tax. To request that a purchase using another ars title code be exempt from sales tax. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. It.

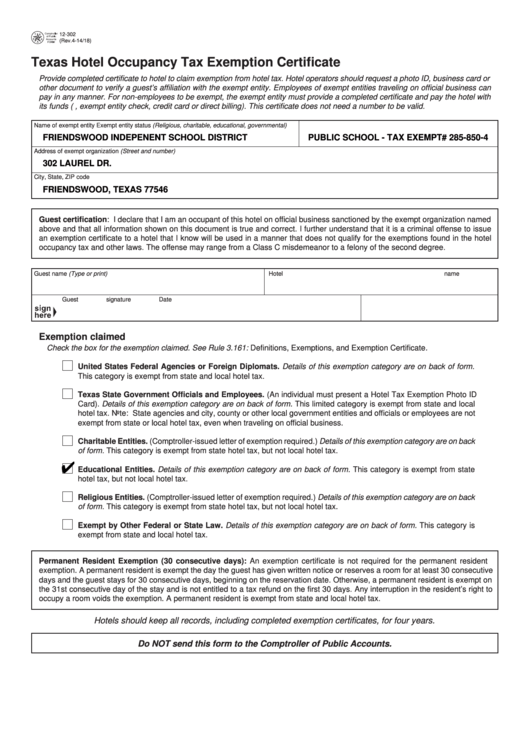

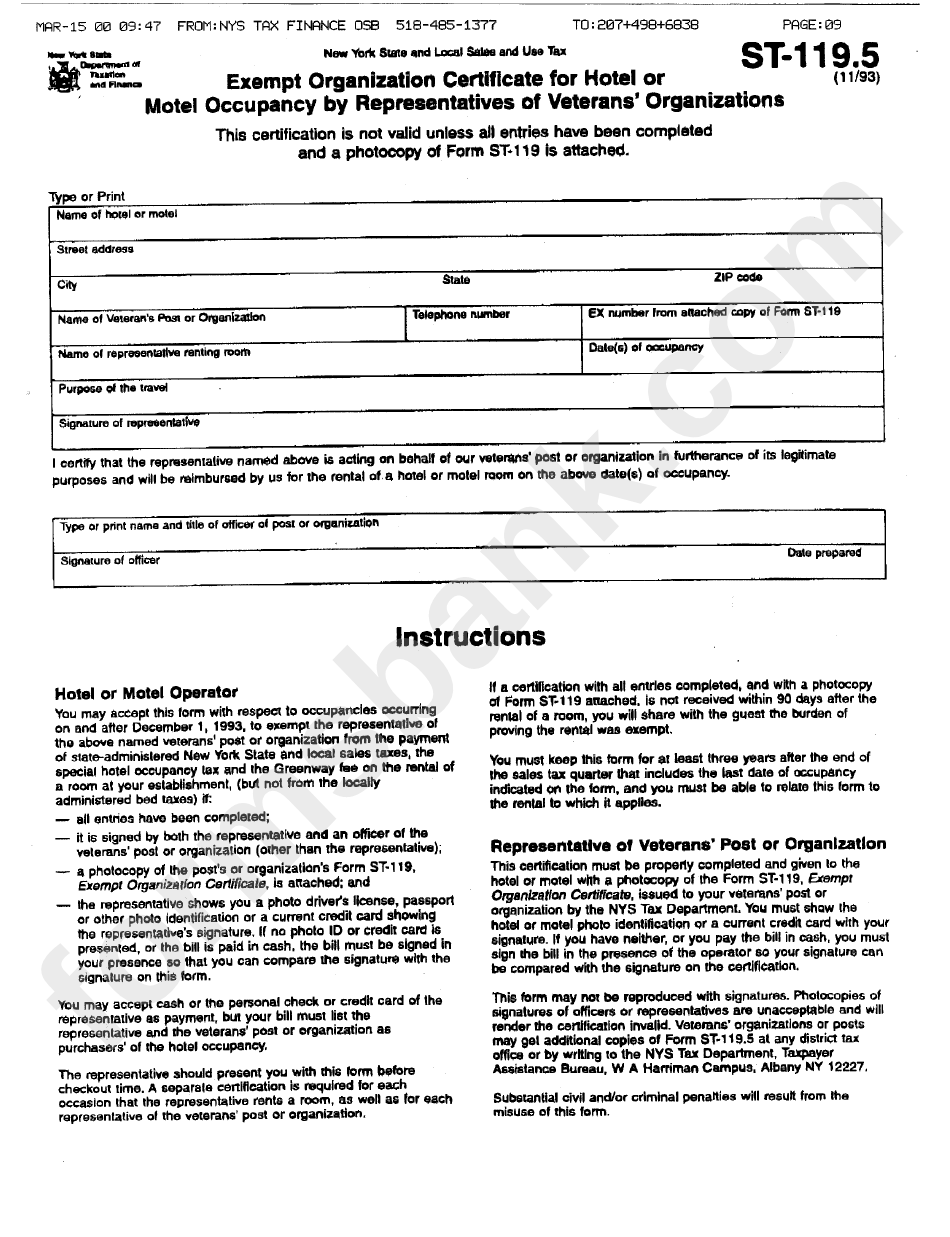

Fillable Texas Hotel Occupancy Tax Exemption Certificate Printable Pdf

Download form 5000 to claim state and city tax deductions or exemptions for transactions in arizona. This form is used to claim state and city tax exemptions or deductions for various transactions in arizona. Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before. Arizona form 5000 transaction privilege.

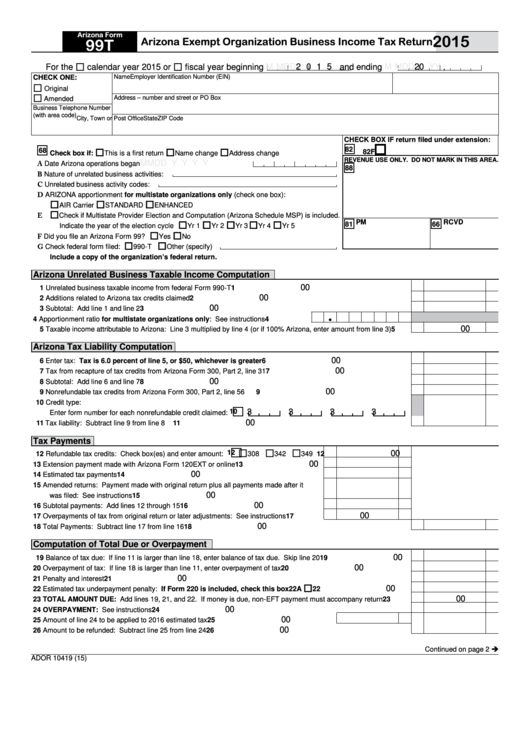

Tax Exempt Form Az

Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. Download form 5000 to claim state and city tax deductions or exemptions for transactions in arizona. Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before. This form is used to claim.

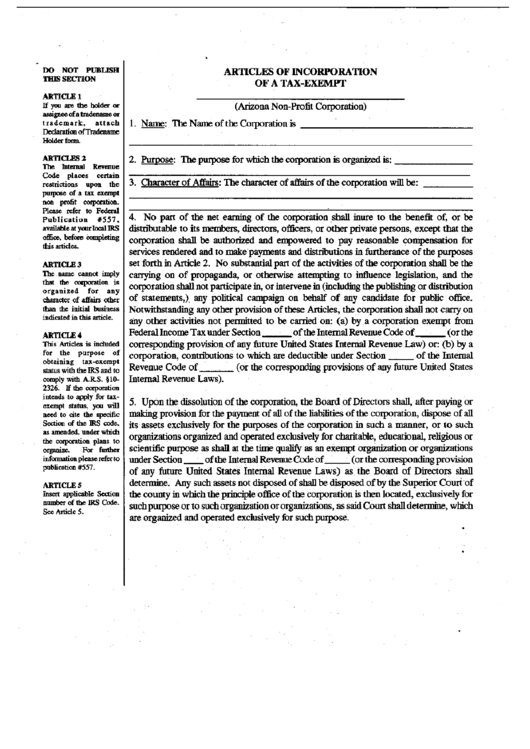

Articles Of Incorporation Of A TaxExempt Form Arizona printable pdf

Download form 5000 to claim state and city tax deductions or exemptions for transactions in arizona. This form is used to claim state and city tax exemptions or deductions for various transactions in arizona. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. To request that a purchase using another ars title.

California Hotel Tax Exempt Form Pdf

Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. It must be filled out by the purchaser. Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before. To request that a purchase using another ars title code be exempt from sales.

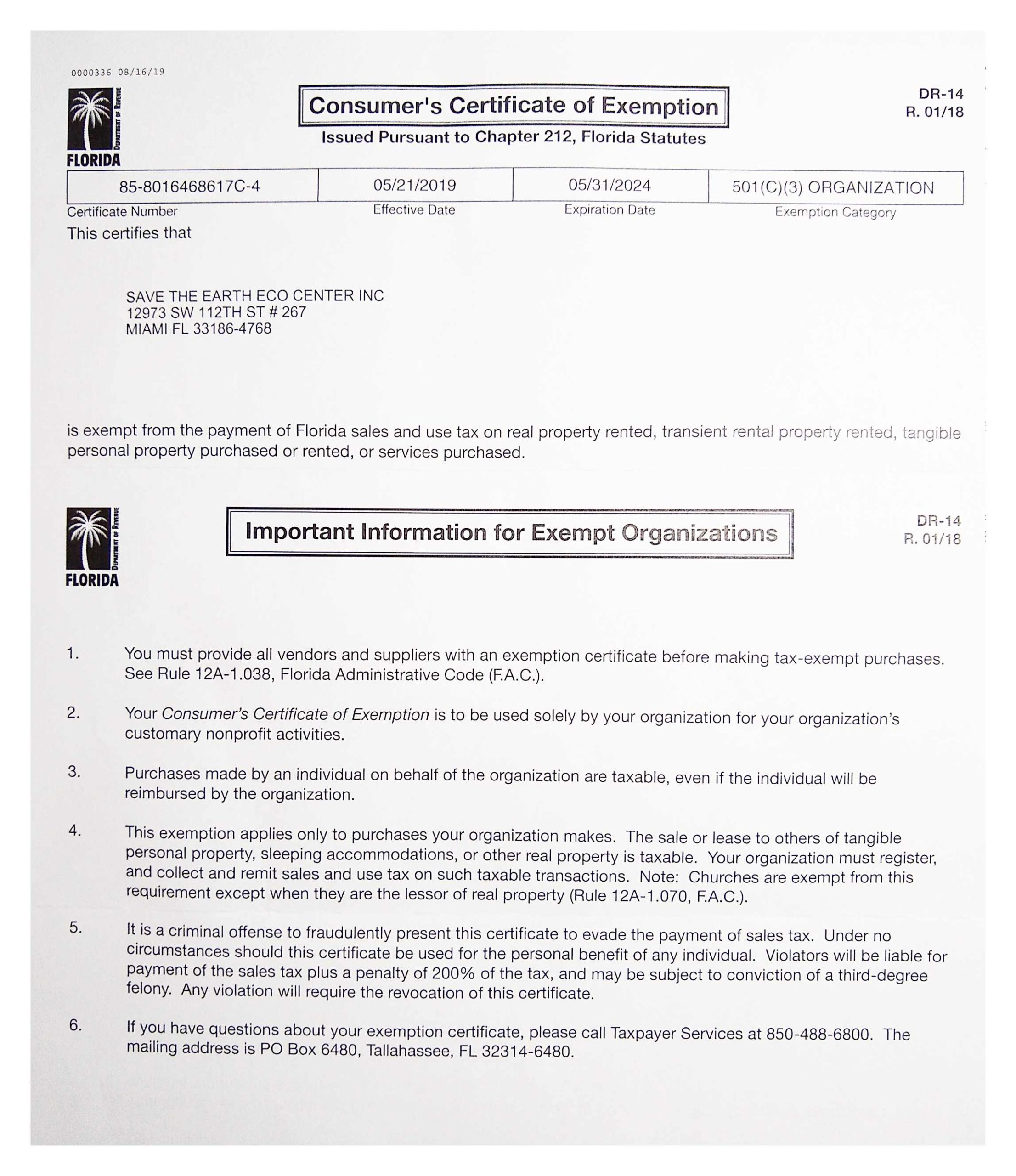

Florida Sales And Use Tax Certificate Of Exemption Form

Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. This establishes a basis for state and city tax. This form is used to claim state and city tax exemptions or deductions.

Fillable Arizona Form 5000 Transaction Privilege Tax Exemption

To request that a purchase using another ars title code be exempt from sales tax. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. It must be filled out by the purchaser. This form is used to claim state and city tax exemptions or deductions for various transactions in arizona. This establishes.

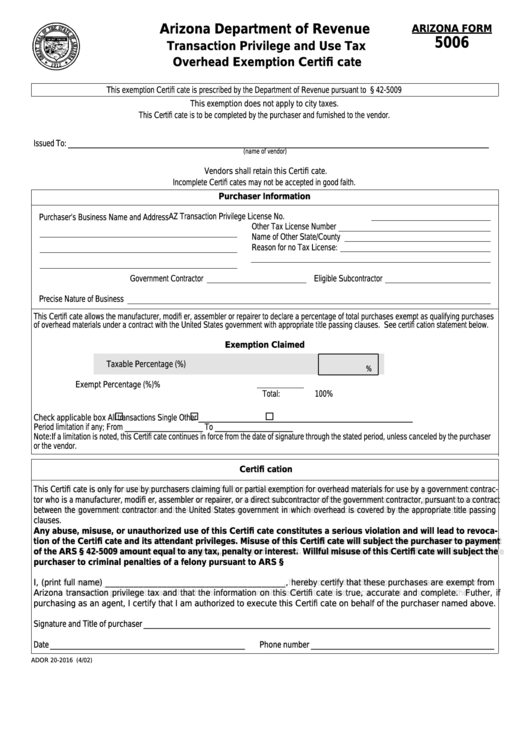

Arizona Sales And Use Tax Exemption Form

Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. Download form 5000 to claim state and city tax deductions or exemptions for transactions in arizona. To request that a purchase using another ars title code be exempt from sales tax. This establishes a basis for state and city tax. It must be.

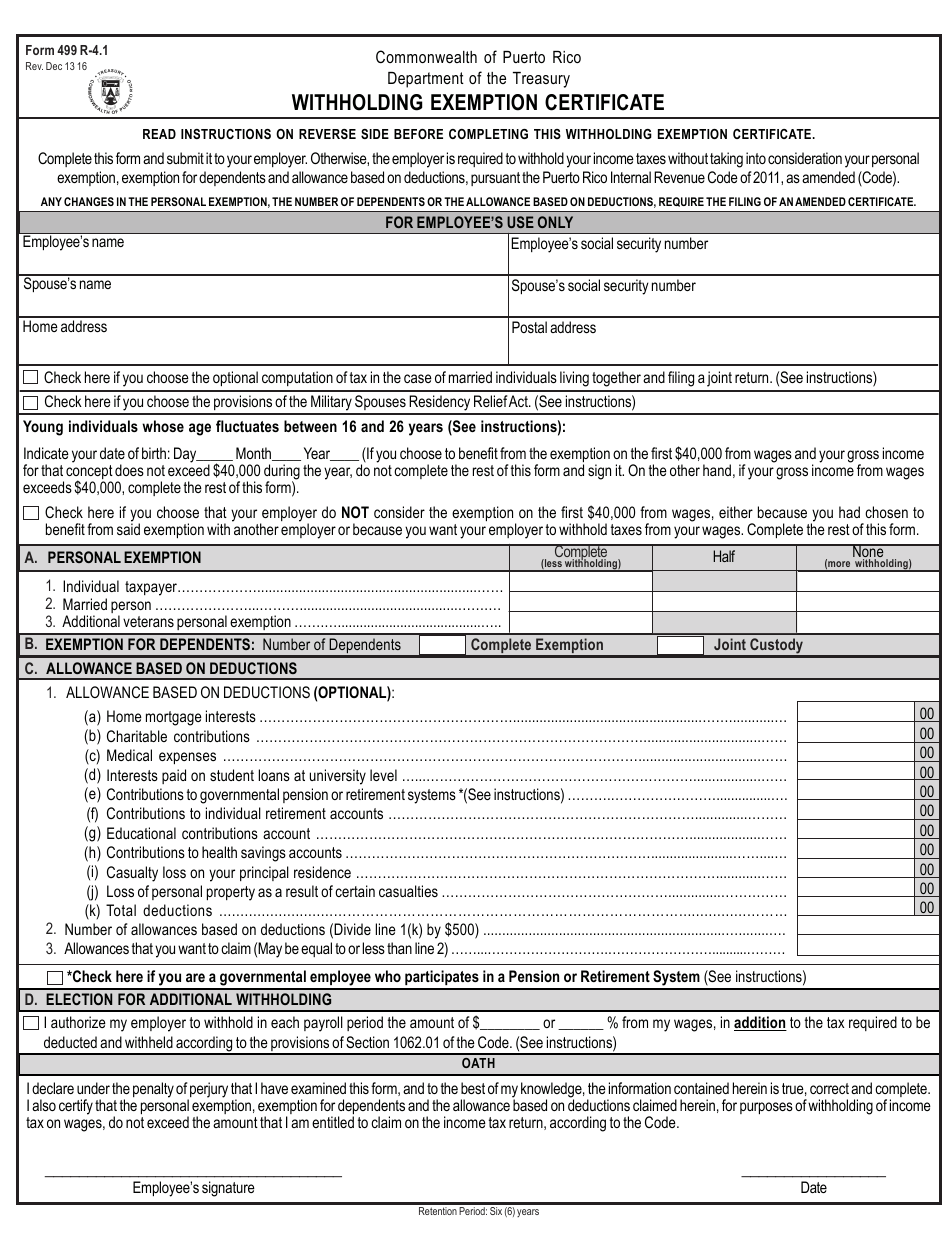

Puerto Rico Hotel Tax Exempt Form

This establishes a basis for state and city tax. It must be filled out by the purchaser. Download form 5000 to claim state and city tax deductions or exemptions for transactions in arizona. This form is used to claim state and city tax exemptions or deductions for various transactions in arizona. Read the information below, the instructions for the dor.

Arizona Tax Exempt Form

Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. This establishes a basis for state and city tax. This form is used to claim state and city tax exemptions or deductions.

This Form Is Used To Claim State And City Tax Exemptions Or Deductions For Various Transactions In Arizona.

Read the information below, the instructions for the dor 82514 affidavit (following), and the information on the dor 82514 carefully before. This establishes a basis for state and city tax. To request that a purchase using another ars title code be exempt from sales tax. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue.

Download Form 5000 To Claim State And City Tax Deductions Or Exemptions For Transactions In Arizona.

It must be filled out by the purchaser.