Ca State Tax Extension Form

Ca State Tax Extension Form - Check with your software provider to. Individuals can make an extension or estimated tax payment using tax preparation software. Pay your additional tax with another form ftb 3519. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Find out how to get an extension of time to file your income tax return. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. If you have efiled a federal extension and do not owe california income taxes or expect a tax refund by the tax deadline, your. Learn how to file an automatic extension of time to file your california state income tax return until october 15 or december 15, depending on your. You must file by the deadline to avoid a late filing penalty.

If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Individuals can make an extension or estimated tax payment using tax preparation software. Find out how to get an extension of time to file your income tax return. Learn how to file an automatic extension of time to file your california state income tax return until october 15 or december 15, depending on your. Pay your additional tax with another form ftb 3519. You must file by the deadline to avoid a late filing penalty. Check with your software provider to. If you have efiled a federal extension and do not owe california income taxes or expect a tax refund by the tax deadline, your. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment.

If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Individuals can make an extension or estimated tax payment using tax preparation software. Check with your software provider to. You must file by the deadline to avoid a late filing penalty. Pay your additional tax with another form ftb 3519. Find out how to get an extension of time to file your income tax return. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Learn how to file an automatic extension of time to file your california state income tax return until october 15 or december 15, depending on your. If you have efiled a federal extension and do not owe california income taxes or expect a tax refund by the tax deadline, your.

Tax extension IRS automatically give without filing Form 4868 if you do

Pay your additional tax with another form ftb 3519. If you have efiled a federal extension and do not owe california income taxes or expect a tax refund by the tax deadline, your. Check with your software provider to. You must file by the deadline to avoid a late filing penalty. You must submit a request for extension no later.

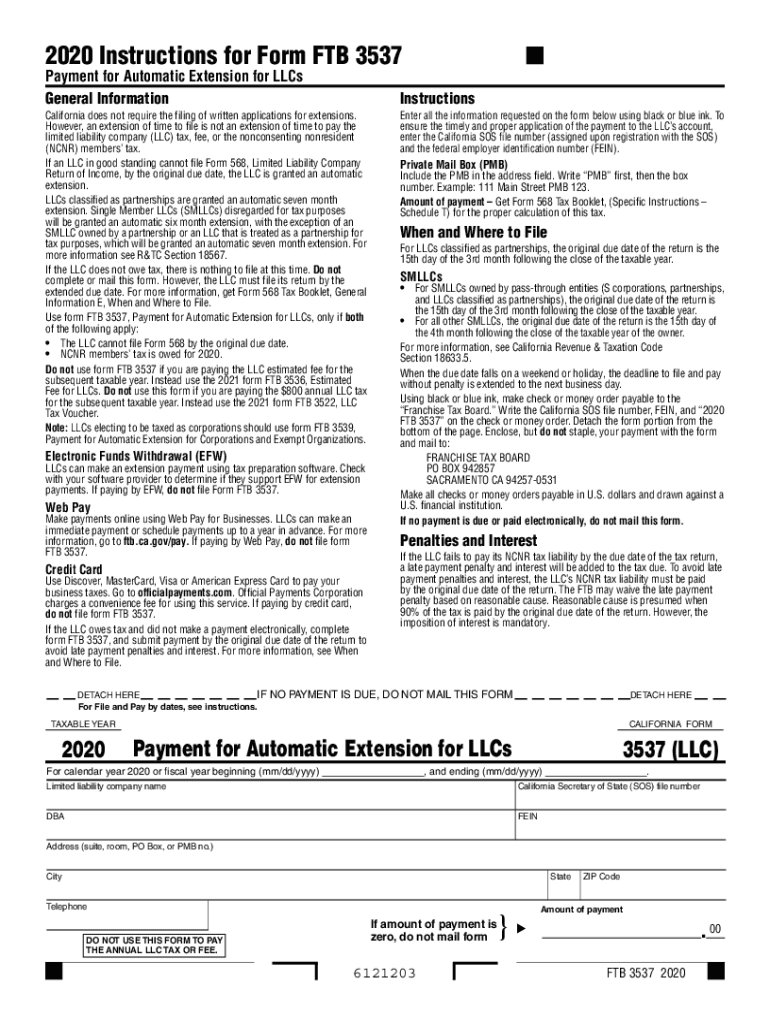

CA FTB 3537 20202022 Fill out Tax Template Online US Legal Forms

If you have efiled a federal extension and do not owe california income taxes or expect a tax refund by the tax deadline, your. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Pay your additional tax with another form ftb 3519. You must file.

California Tax Extension Form 2024 Suki Marcille

Pay your additional tax with another form ftb 3519. You must file by the deadline to avoid a late filing penalty. Learn how to file an automatic extension of time to file your california state income tax return until october 15 or december 15, depending on your. Find out how to get an extension of time to file your income.

Federal Tax Extension Form Printable Printable Forms Free Online

Find out how to get an extension of time to file your income tax return. Check with your software provider to. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Pay your additional tax with another form ftb 3519. You must submit a request for extension no later than.

Tax Deadline 2024 Extension Form Amelia Corinne

Check with your software provider to. Pay your additional tax with another form ftb 3519. Individuals can make an extension or estimated tax payment using tax preparation software. Learn how to file an automatic extension of time to file your california state income tax return until october 15 or december 15, depending on your. If you do not file your.

Tax Extension 2023 Form Printable Forms Free Online

You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Pay your additional tax with another form ftb 3519. If you have efiled a federal extension and do not owe california income taxes or expect a tax refund by the tax deadline, your. Check with your.

Ca State Tax Extension 2024 Iris Melissa

If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Check with your software provider to. You must file by the deadline to avoid a late filing penalty. You must submit a request for extension no later than one month after the due date of your return or prepayment form.

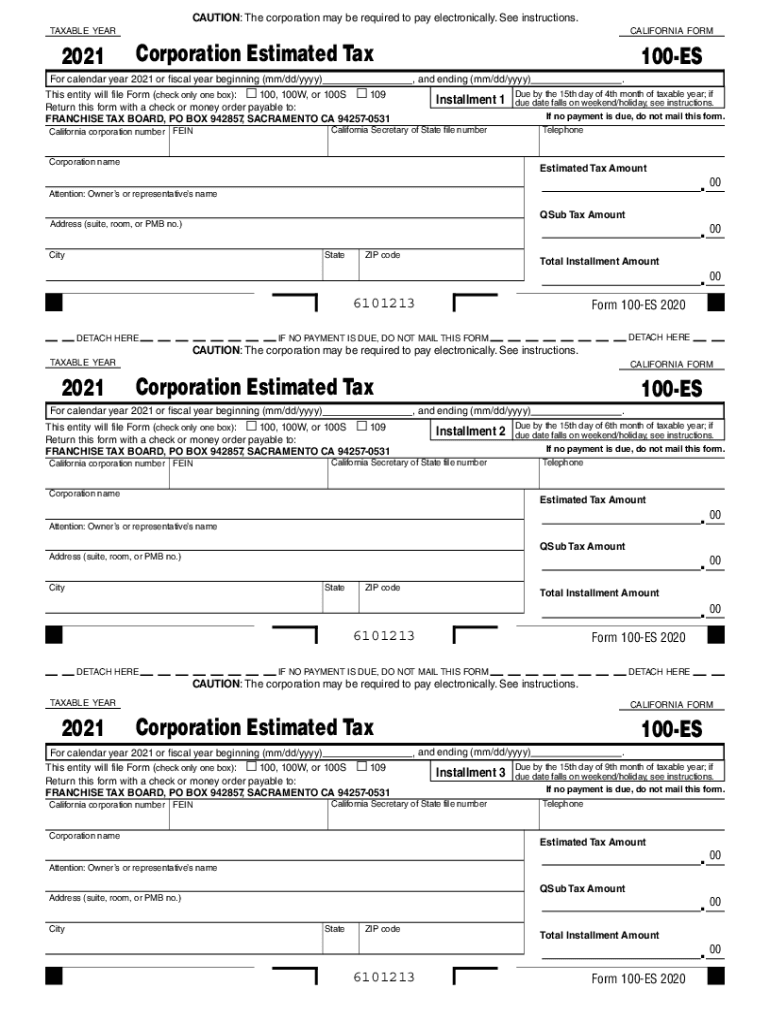

2021 California Estimated Tax Worksheet

Learn how to file an automatic extension of time to file your california state income tax return until october 15 or december 15, depending on your. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Check with your software provider to. Individuals can make an extension or estimated tax.

2018 forms Fill out & sign online DocHub

You must file by the deadline to avoid a late filing penalty. Individuals can make an extension or estimated tax payment using tax preparation software. Find out how to get an extension of time to file your income tax return. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus..

How to file my business’s state tax extension in ExpressExtension?

You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Find out how to get an extension of time to file your income tax return. Check with your software provider to. Pay your additional tax with another form ftb 3519. If you do not file your.

Pay Your Additional Tax With Another Form Ftb 3519.

Learn how to file an automatic extension of time to file your california state income tax return until october 15 or december 15, depending on your. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment. Individuals can make an extension or estimated tax payment using tax preparation software. You must file by the deadline to avoid a late filing penalty.

If You Have Efiled A Federal Extension And Do Not Owe California Income Taxes Or Expect A Tax Refund By The Tax Deadline, Your.

Find out how to get an extension of time to file your income tax return. If you do not file your tax return by october 16, 2023, you will incur a late filing penalty plus. Check with your software provider to.

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png)