Deadline To File Form 5500

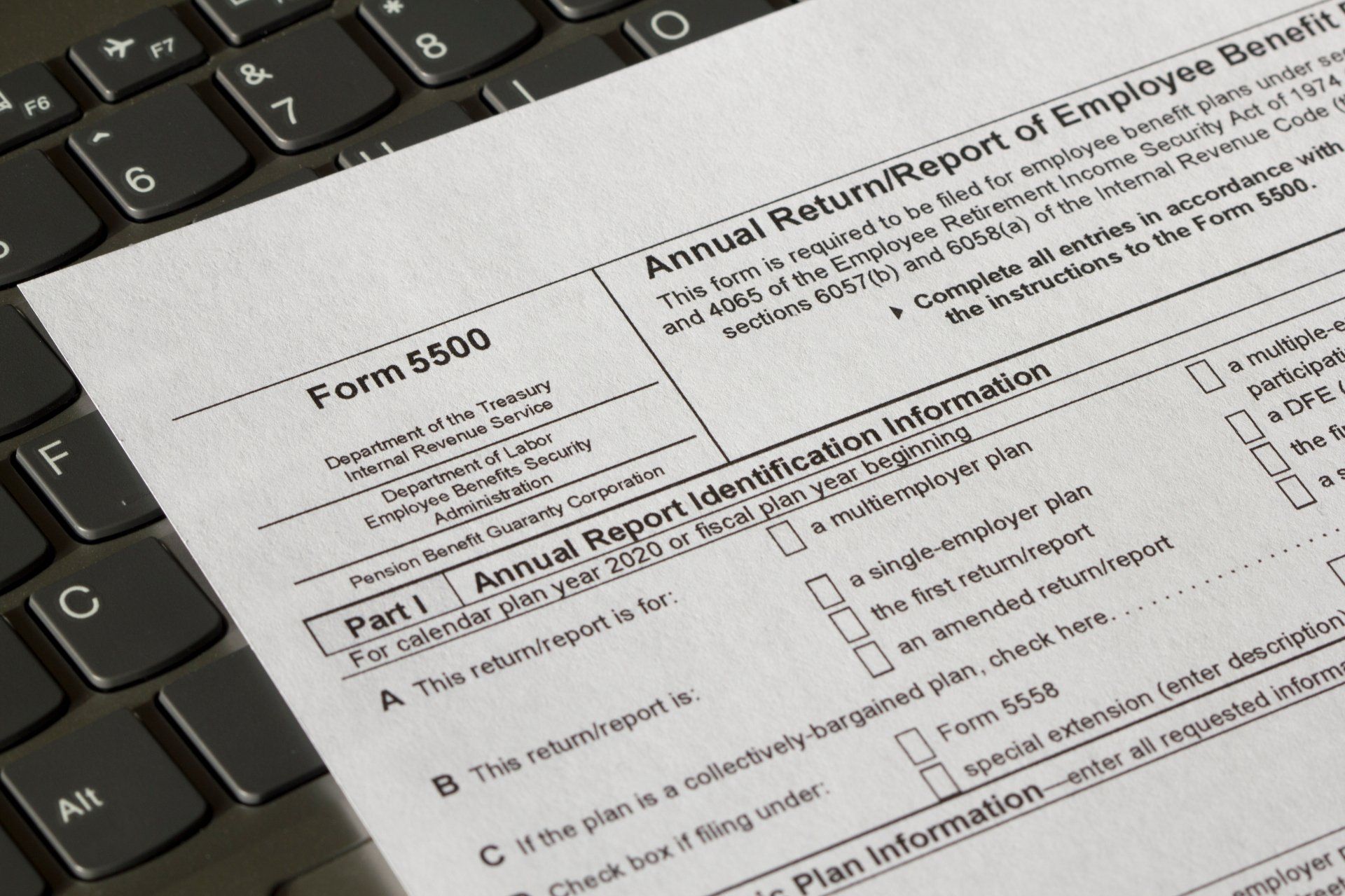

Deadline To File Form 5500 - Refer to the following 5500 due date and electronic filing information. Form 5500 (annual report) for each employee benefit plan. Whether a plan maintains a calendar year. There's no limit for the grace period on a rejected 5500 return,. The deadline to file is linked to the last day of the plan year. What is the deadline to file? July 31, 2024 for calendar year.

There's no limit for the grace period on a rejected 5500 return,. The deadline to file is linked to the last day of the plan year. Refer to the following 5500 due date and electronic filing information. Form 5500 (annual report) for each employee benefit plan. July 31, 2024 for calendar year. What is the deadline to file? Whether a plan maintains a calendar year.

Form 5500 (annual report) for each employee benefit plan. What is the deadline to file? The deadline to file is linked to the last day of the plan year. July 31, 2024 for calendar year. Whether a plan maintains a calendar year. Refer to the following 5500 due date and electronic filing information. There's no limit for the grace period on a rejected 5500 return,.

Reminder Form 5500 Filing Deadline is July 31, 2024, for 2023 Calendar

Form 5500 (annual report) for each employee benefit plan. There's no limit for the grace period on a rejected 5500 return,. The deadline to file is linked to the last day of the plan year. July 31, 2024 for calendar year. Refer to the following 5500 due date and electronic filing information.

Form 5500 Deadline For Calendar Year Plans Due July 31, 2021 EBI

July 31, 2024 for calendar year. Form 5500 (annual report) for each employee benefit plan. Whether a plan maintains a calendar year. What is the deadline to file? The deadline to file is linked to the last day of the plan year.

Form 5500 Deadline 2024 Margi Saraann

What is the deadline to file? There's no limit for the grace period on a rejected 5500 return,. Refer to the following 5500 due date and electronic filing information. Whether a plan maintains a calendar year. July 31, 2024 for calendar year.

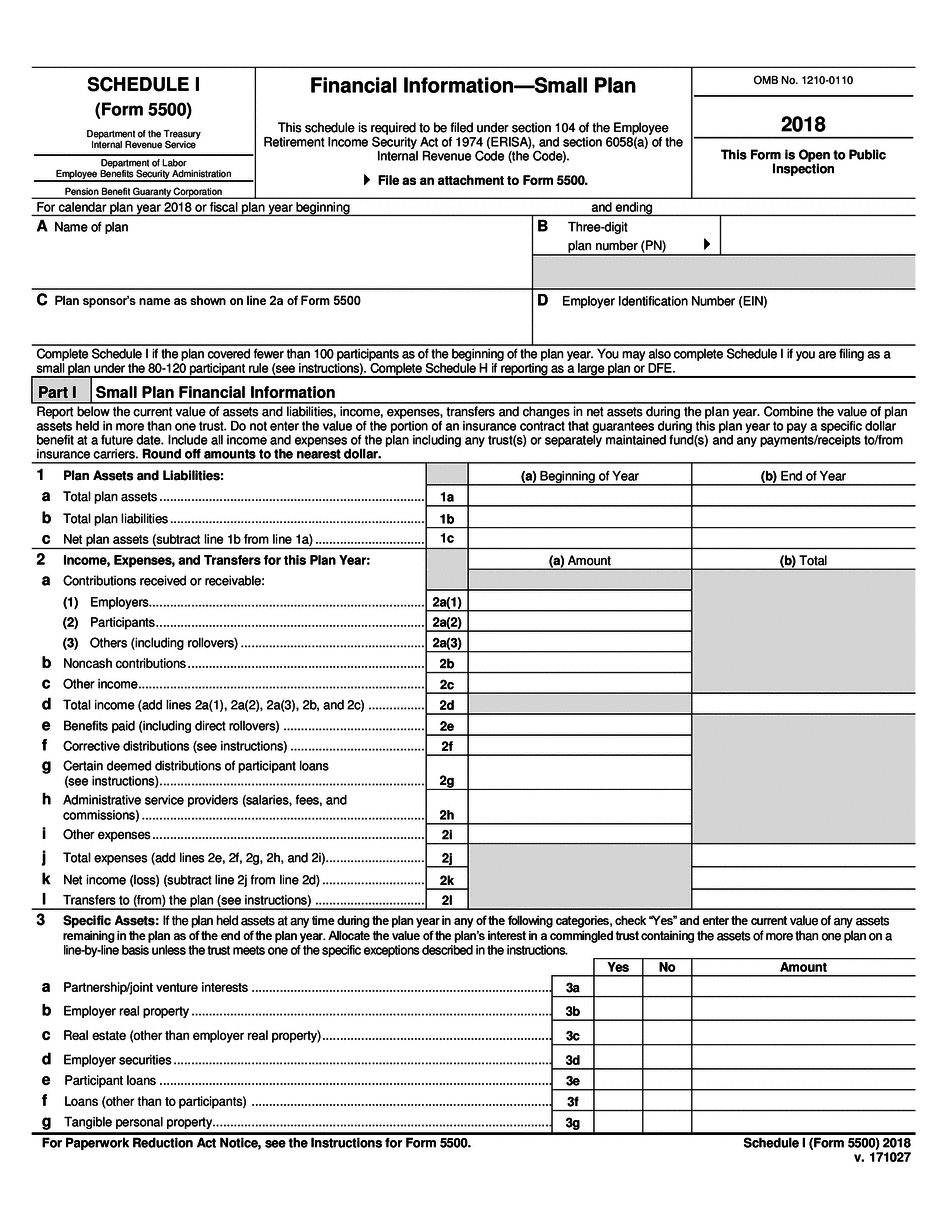

Health Insurance 5500 Filing Requirements

Form 5500 (annual report) for each employee benefit plan. Refer to the following 5500 due date and electronic filing information. What is the deadline to file? There's no limit for the grace period on a rejected 5500 return,. Whether a plan maintains a calendar year.

Compliance Caution Understanding Form 5500 KBI Benefits

Refer to the following 5500 due date and electronic filing information. July 31, 2024 for calendar year. Whether a plan maintains a calendar year. There's no limit for the grace period on a rejected 5500 return,. What is the deadline to file?

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

What is the deadline to file? The deadline to file is linked to the last day of the plan year. Form 5500 (annual report) for each employee benefit plan. Refer to the following 5500 due date and electronic filing information. There's no limit for the grace period on a rejected 5500 return,.

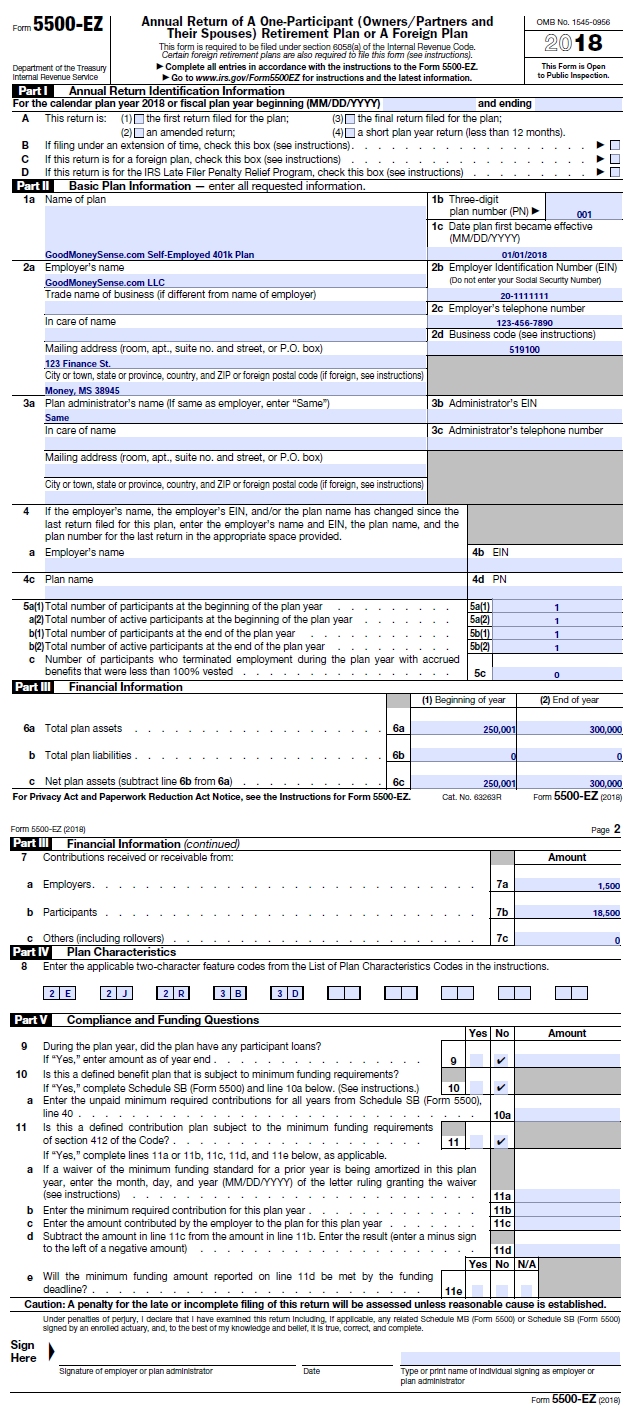

Fillable Form 5500 Ez Printable Forms Free Online

What is the deadline to file? July 31, 2024 for calendar year. Form 5500 (annual report) for each employee benefit plan. There's no limit for the grace period on a rejected 5500 return,. The deadline to file is linked to the last day of the plan year.

Time is Running to File Form 2290 Before the Deadline

There's no limit for the grace period on a rejected 5500 return,. Form 5500 (annual report) for each employee benefit plan. Whether a plan maintains a calendar year. What is the deadline to file? July 31, 2024 for calendar year.

Form 5500 Deadline Video YouTube

Refer to the following 5500 due date and electronic filing information. July 31, 2024 for calendar year. What is the deadline to file? There's no limit for the grace period on a rejected 5500 return,. Whether a plan maintains a calendar year.

Whether A Plan Maintains A Calendar Year.

What is the deadline to file? Form 5500 (annual report) for each employee benefit plan. July 31, 2024 for calendar year. The deadline to file is linked to the last day of the plan year.

Refer To The Following 5500 Due Date And Electronic Filing Information.

There's no limit for the grace period on a rejected 5500 return,.