Double Taxation Means That The Quizlet

Double Taxation Means That The Quizlet - Double taxation means that both a. Study with quizlet and memorize flashcards containing terms like chapter 10 double taxation means that the: What does double taxation mean quizlet? The term double taxation refers to: Wage income and interest income are taxed, which is currently the case in the united states. A) corporation's income tax is. Corporate earnings are subject to double taxation on their income to the. Double taxation applies to corporations. Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on the. Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared.

Explain what double taxation means. Double taxation means that both a. A) corporation's income tax is. Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on the. The term double taxation refers to: The term double taxation refers to the fact that under the u.s. What does double taxation mean quizlet? Wage income and interest income are taxed, which is currently the case in the united states. Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared. Double taxation applies to corporations.

Double taxation applies to corporations. Corporate earnings are subject to double taxation on their income to the. What does double taxation mean quizlet? The term double taxation refers to the fact that under the u.s. Double taxation means that both a. Explain what double taxation means. Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared. Wage income and interest income are taxed, which is currently the case in the united states. Study with quizlet and memorize flashcards containing terms like chapter 10 double taxation means that the: A) corporation's income tax is.

What Is Double Taxation Meaning, Definition & Examples Finschool

Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared. A) corporation's income tax is. Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on the. Explain what double taxation means. Double taxation applies to corporations.

Double Taxation How does Double Taxation works with Example?

Wage income and interest income are taxed, which is currently the case in the united states. Double taxation means that both a. Explain what double taxation means. Study with quizlet and memorize flashcards containing terms like chapter 10 double taxation means that the: Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes.

Double taxation persists on securities amid EU tax harmonisation

Study with quizlet and memorize flashcards containing terms like chapter 10 double taxation means that the: Wage income and interest income are taxed, which is currently the case in the united states. Explain what double taxation means. The term double taxation refers to the fact that under the u.s. Corporate earnings are subject to double taxation on their income to.

Methods of avoiding the double taxation

Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on the. Double taxation means that both a. Explain what double taxation means. What does double taxation mean quizlet? Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared.

How Can We Avoid Double Taxation Tax and accounting services for

Explain what double taxation means. Double taxation applies to corporations. A) corporation's income tax is. Double taxation means that both a. Wage income and interest income are taxed, which is currently the case in the united states.

What is Double Taxation?

Double taxation applies to corporations. What does double taxation mean quizlet? Corporate earnings are subject to double taxation on their income to the. Wage income and interest income are taxed, which is currently the case in the united states. Explain what double taxation means.

DOUBLE TAXATION text on the yellow paper with pen and glasses 11027849

Study with quizlet and memorize flashcards containing terms like chapter 10 double taxation means that the: Double taxation applies to corporations. The term double taxation refers to the fact that under the u.s. Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared. What does double taxation mean.

What Does Corporation Double Taxation Means? California Business

Explain what double taxation means. Corporate earnings are subject to double taxation on their income to the. Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared. What does double taxation mean quizlet? A) corporation's income tax is.

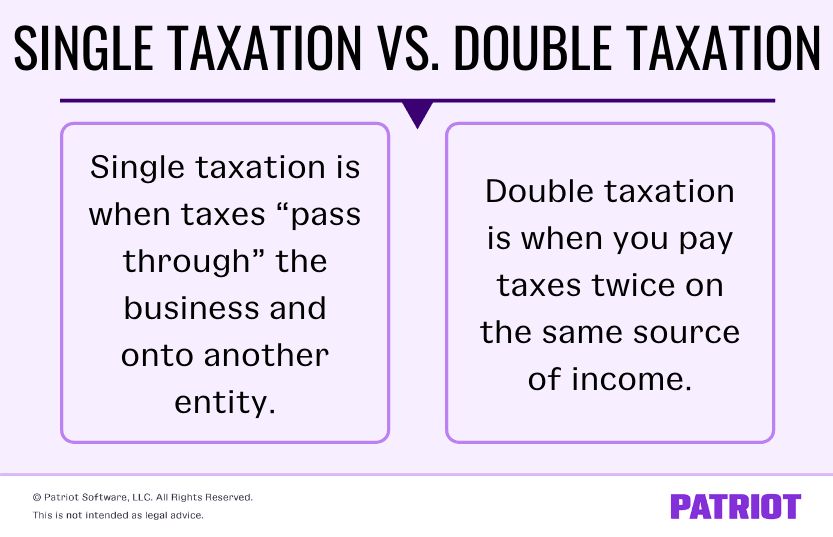

Single Taxation vs. Double Taxation Overview, Pros, Cons, & More

Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared. Corporate earnings are subject to double taxation on their income to the. Explain what double taxation means. Wage income and interest income are taxed, which is currently the case in the united states. The term double taxation refers.

All About the Double Taxation Relief

The term double taxation refers to: Double taxation means that both a. A) corporation's income tax is. Study with quizlet and memorize flashcards containing terms like the property of the owner, except for taxes owed to the government, shared. What does double taxation mean quizlet?

Study With Quizlet And Memorize Flashcards Containing Terms Like The Property Of The Owner, Except For Taxes Owed To The Government, Shared.

Wage income and interest income are taxed, which is currently the case in the united states. What does double taxation mean quizlet? Double taxation applies to corporations. Explain what double taxation means.

Study With Quizlet And Memorize Flashcards Containing Terms Like Chapter 10 Double Taxation Means That The:

Corporate earnings are subject to double taxation on their income to the. A) corporation's income tax is. The term double taxation refers to the fact that under the u.s. The term double taxation refers to:

Corporations Must Pay Income Taxes On Their Net Income, And Their Stockholders Must Pay Income Taxes On The.

Double taxation means that both a.