Form 5329 Waiver Example

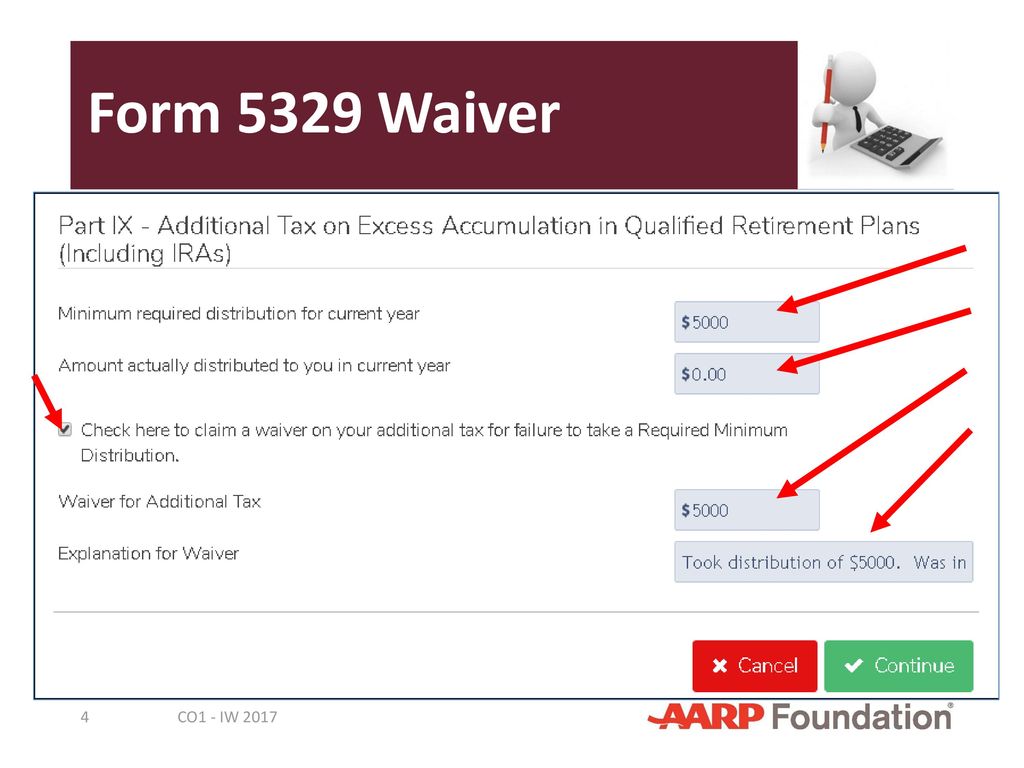

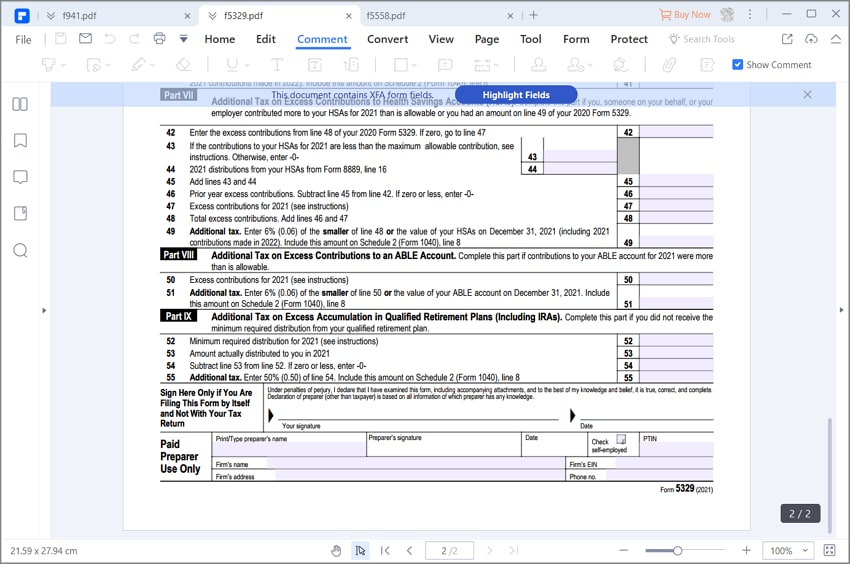

Form 5329 Waiver Example - Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). The 2017 form 5329 will be. I missed an rmd from my ira in 2018. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. (the waiver would only be denied if there is no reasonable explanation and the missed rmd was not taken. My plan is to file the 5329 prior to filing an extension in. Keep in mind, if the irs wants to impose. You will need to file a 5329 form and request a waiver of the penalty. This distribution will be reported on your 2016 tax return.

(the waiver would only be denied if there is no reasonable explanation and the missed rmd was not taken. The 2017 form 5329 will be. Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. This distribution will be reported on your 2016 tax return. My plan is to file the 5329 prior to filing an extension in. Keep in mind, if the irs wants to impose. You will need to file a 5329 form and request a waiver of the penalty. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. I missed an rmd from my ira in 2018. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd).

Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. (the waiver would only be denied if there is no reasonable explanation and the missed rmd was not taken. You will need to file a 5329 form and request a waiver of the penalty. The 2017 form 5329 will be. Keep in mind, if the irs wants to impose. My plan is to file the 5329 prior to filing an extension in. This distribution will be reported on your 2016 tax return. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). I missed an rmd from my ira in 2018.

TaxSlayer Changes Tax Year ppt download

You will need to file a 5329 form and request a waiver of the penalty. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. My plan is to file the 5329 prior to filing an extension in. Keep in.

Form 5329 Instructions Taxes on TaxFavored Accounts Lendstart

My plan is to file the 5329 prior to filing an extension in. Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. The 2017 form 5329 will be. This distribution will be reported on your 2016 tax return. I am filing a form 5329 to request a waiver of the penalty (50% of the.

Instructions For Form 5329 2010 printable pdf download

The 2017 form 5329 will be. (the waiver would only be denied if there is no reasonable explanation and the missed rmd was not taken. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. This distribution will be reported.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

You will need to file a 5329 form and request a waiver of the penalty. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. Keep in mind, if the irs wants to impose. Yes, the form 5329 requesting the.

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

My plan is to file the 5329 prior to filing an extension in. Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. I missed an rmd from my ira in 2018. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will.

TaxSlayer Changes Tax Year ppt download

I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. (the waiver would only be denied if there is no reasonable explanation.

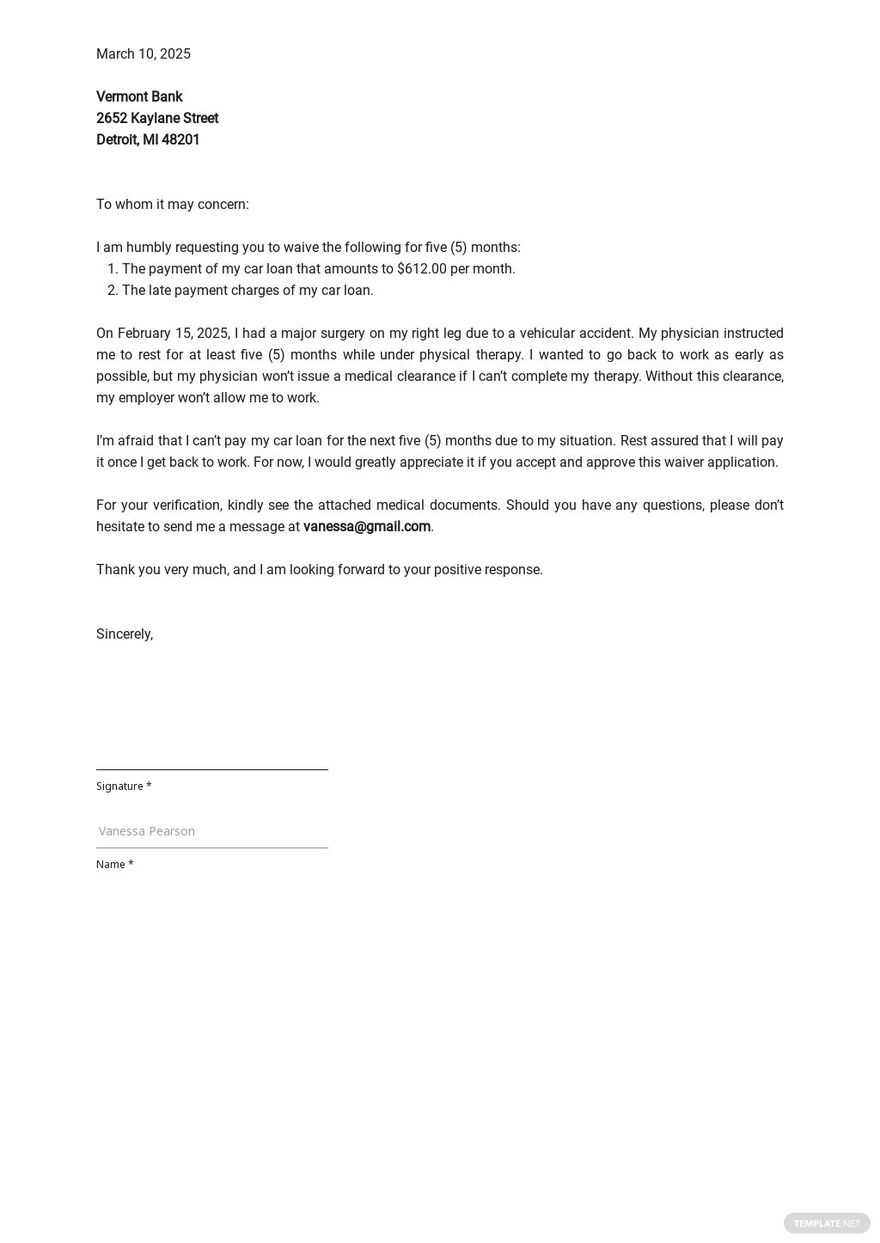

Letter Of Waiver Template In Word And Pdf Formats Images and Photos

For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. I am filing a form 5329 to request a waiver of the penalty (50% of.

letter waiver Doc Template pdfFiller

The 2017 form 5329 will be. (the waiver would only be denied if there is no reasonable explanation and the missed rmd was not taken. Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. Keep in mind, if the irs wants to impose. I missed an rmd from my ira in 2018.

Comment remplir le formulaire 5329 de l'IRS

Keep in mind, if the irs wants to impose. This distribution will be reported on your 2016 tax return. I missed an rmd from my ira in 2018. The 2017 form 5329 will be. Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return.

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank

Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure. The 2017 form 5329 will be. Keep in mind, if the irs wants to impose..

The 2017 Form 5329 Will Be.

I missed an rmd from my ira in 2018. (the waiver would only be denied if there is no reasonable explanation and the missed rmd was not taken. Keep in mind, if the irs wants to impose. For example, if the missed rmd for 2016 was $390 and the missed rmd for 2017 was $410, your 2016 form 5329 will be as shown in the attached figure.

This Distribution Will Be Reported On Your 2016 Tax Return.

I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). You will need to file a 5329 form and request a waiver of the penalty. Yes, the form 5329 requesting the waiver must be filed with your 2015 tax return. My plan is to file the 5329 prior to filing an extension in.