Form Or 19

Form Or 19 - The due date for entities using a calendar 2023 tax. Want to make your payment online? Important—complete page 2 before signing and mailing form. Sign below and keep a copy of. Submit original form—do not submit photocopy. Mail the payment and voucher to: This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed. This form is due on the last day of the second month after the end of the entity’s tax year.

This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed. Important—complete page 2 before signing and mailing form. Sign below and keep a copy of. The due date for entities using a calendar 2023 tax. Want to make your payment online? Mail the payment and voucher to: This form is due on the last day of the second month after the end of the entity’s tax year. Submit original form—do not submit photocopy.

Want to make your payment online? Submit original form—do not submit photocopy. Sign below and keep a copy of. The due date for entities using a calendar 2023 tax. Mail the payment and voucher to: This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed. Important—complete page 2 before signing and mailing form. This form is due on the last day of the second month after the end of the entity’s tax year.

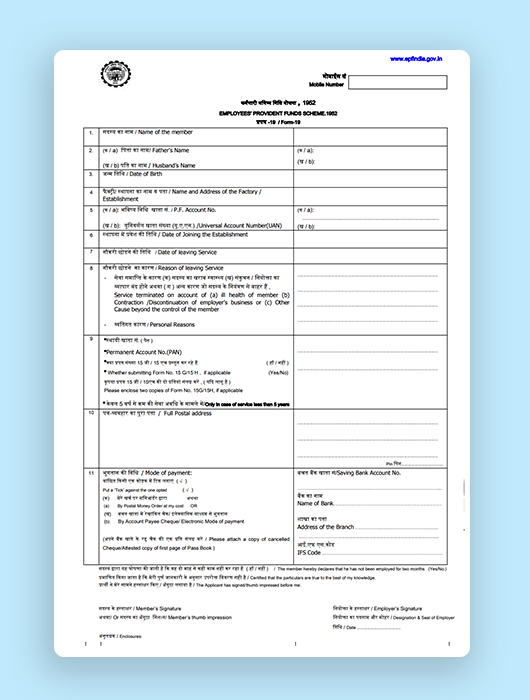

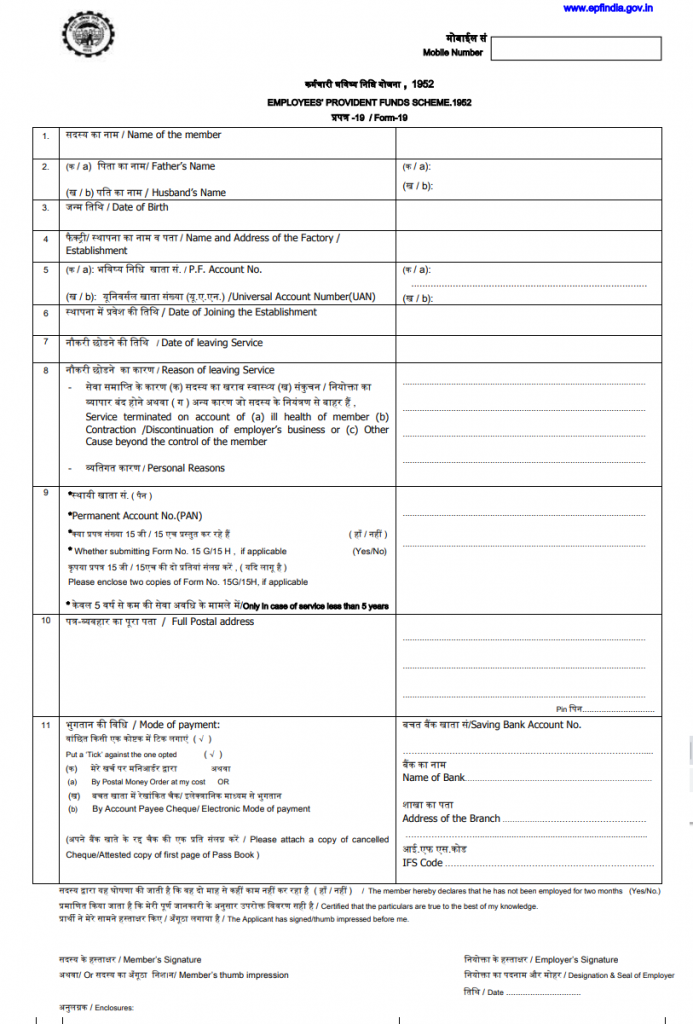

Know Your EPFO Forms 5 Important Forms to Help You Manage Your EPF and

The due date for entities using a calendar 2023 tax. Important—complete page 2 before signing and mailing form. Want to make your payment online? Mail the payment and voucher to: This form is due on the last day of the second month after the end of the entity’s tax year.

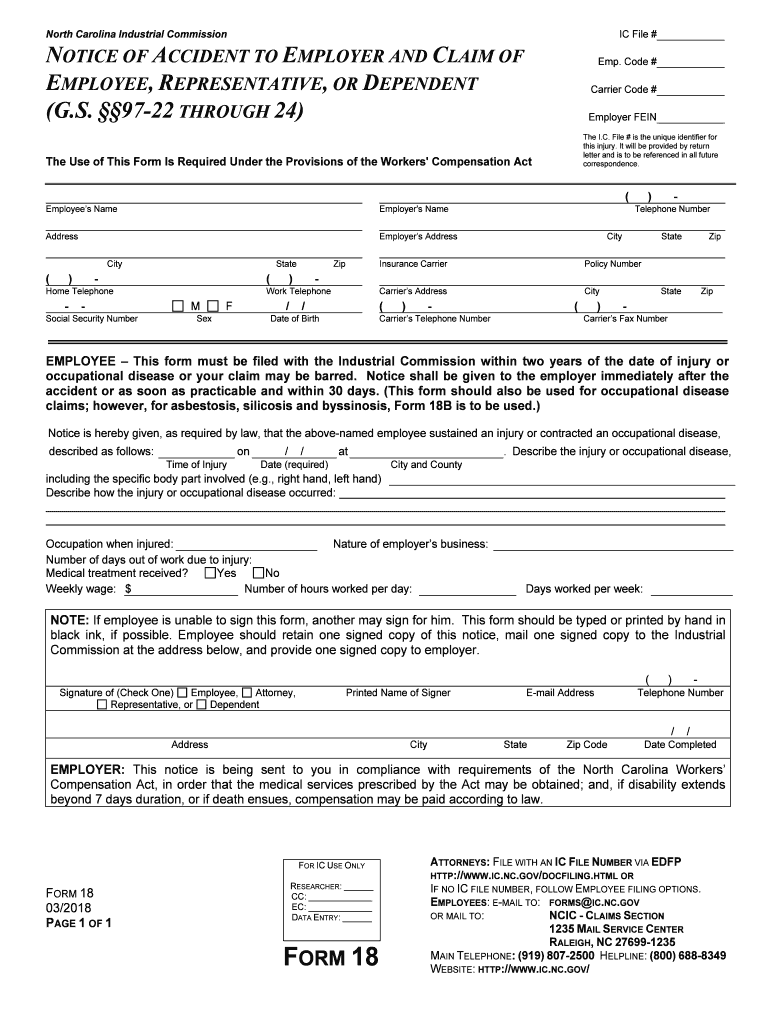

Fillable Form 19 Nc Printable Forms Free Online

Submit original form—do not submit photocopy. This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed. Mail the payment and voucher to: The due date for entities using a calendar 2023 tax. This form is due on the last day of the second month after the end.

Form 19 NC Industrial Commission NC Gov Fill Out and Sign Printable

Sign below and keep a copy of. Submit original form—do not submit photocopy. This form is due on the last day of the second month after the end of the entity’s tax year. Important—complete page 2 before signing and mailing form. Want to make your payment online?

Form 19 EASA PDF PDF

Submit original form—do not submit photocopy. Want to make your payment online? The due date for entities using a calendar 2023 tax. Sign below and keep a copy of. Mail the payment and voucher to:

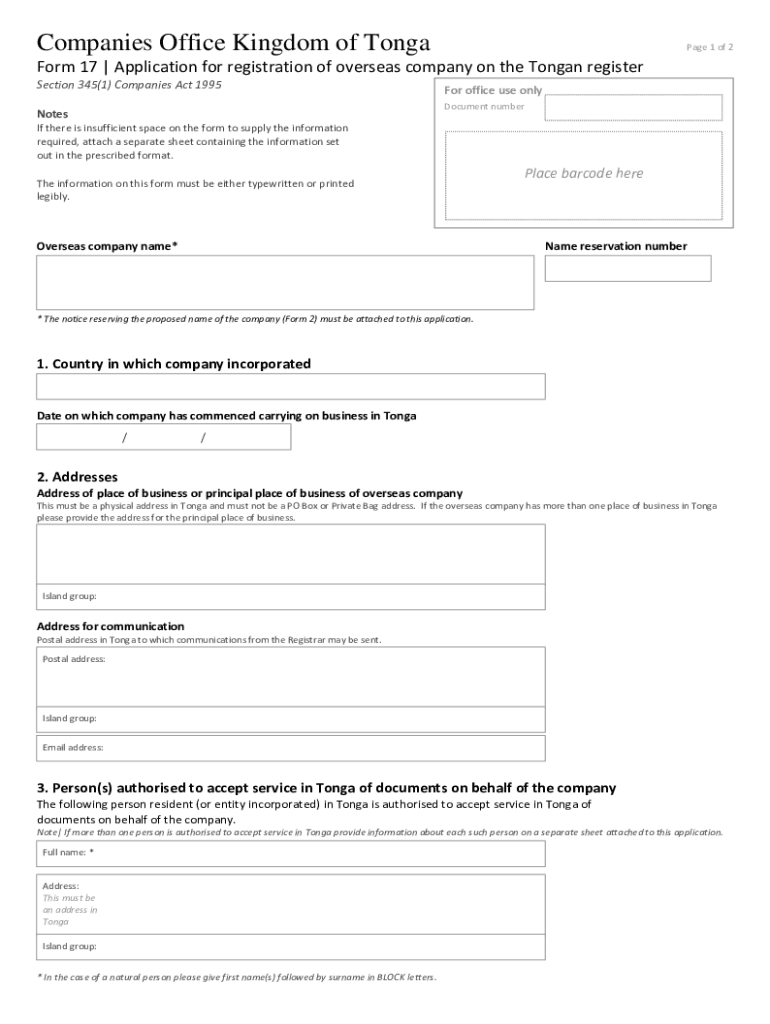

Form 19 Application for Registration of Overseas Company on the Tongan

Important—complete page 2 before signing and mailing form. This form is due on the last day of the second month after the end of the entity’s tax year. This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed. The due date for entities using a calendar 2023.

EPF Form 19 Steps to Fill Form 19 for PF Withdrawal in 2022

Mail the payment and voucher to: Want to make your payment online? This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed. The due date for entities using a calendar 2023 tax. Submit original form—do not submit photocopy.

PF withdrawal process Form 19 (EPF) & Form 10C (EPS)

Sign below and keep a copy of. The due date for entities using a calendar 2023 tax. Want to make your payment online? Mail the payment and voucher to: This form is due on the last day of the second month after the end of the entity’s tax year.

EPF Form 19 How to Fill Form for Final PF Settlement Online

The due date for entities using a calendar 2023 tax. Sign below and keep a copy of. Important—complete page 2 before signing and mailing form. Submit original form—do not submit photocopy. This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed.

Rutile Free Form 19 The Crystal Council

Want to make your payment online? Mail the payment and voucher to: Sign below and keep a copy of. This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed. Important—complete page 2 before signing and mailing form.

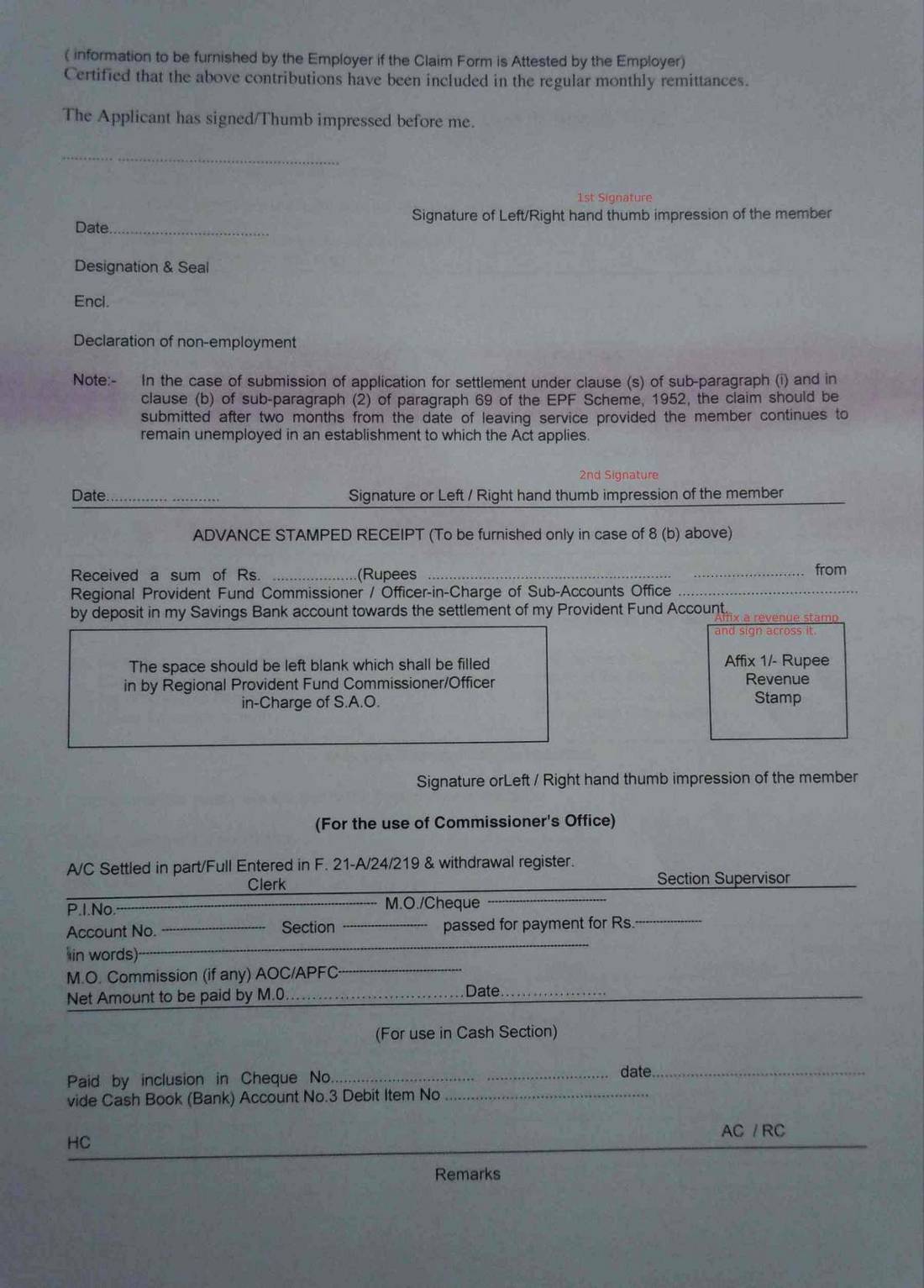

PF FORM 19 Claim Settled And FORM 10 C Claim Under Process EPF

Mail the payment and voucher to: Submit original form—do not submit photocopy. This form must be resubmitted if the pte information entered above changes or if the ownership percentage of an owner that has filed. This form is due on the last day of the second month after the end of the entity’s tax year. Want to make your payment.

Sign Below And Keep A Copy Of.

This form is due on the last day of the second month after the end of the entity’s tax year. Submit original form—do not submit photocopy. Important—complete page 2 before signing and mailing form. The due date for entities using a calendar 2023 tax.

This Form Must Be Resubmitted If The Pte Information Entered Above Changes Or If The Ownership Percentage Of An Owner That Has Filed.

Want to make your payment online? Mail the payment and voucher to: