Homestead Exemption Form Florida

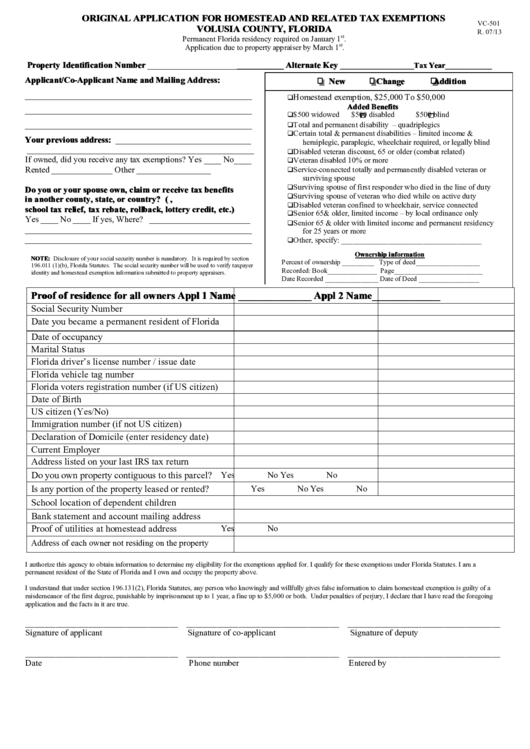

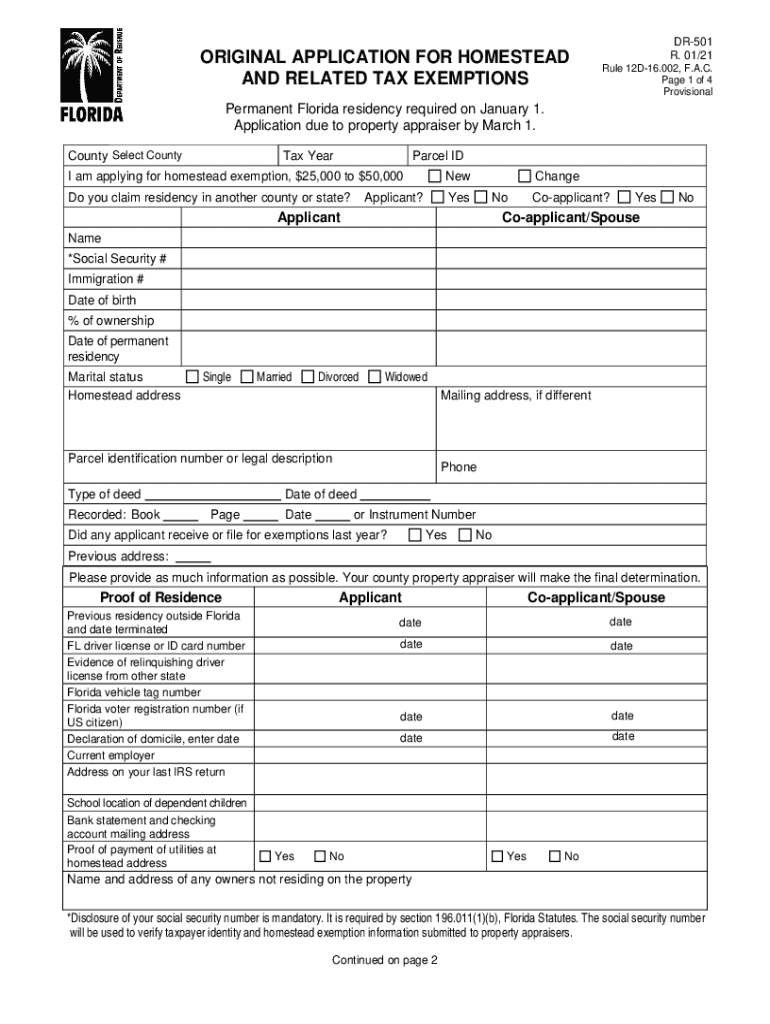

Homestead Exemption Form Florida - When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. The property appraiser has a duty to put a tax lien on your property if. File the signed application for exemption with the county property appraiser. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. Original application for homestead and related tax exemptions permanent florida residency required on january 1.

11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. File the signed application for exemption with the county property appraiser. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. The property appraiser has a duty to put a tax lien on your property if. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. Original application for homestead and related tax exemptions permanent florida residency required on january 1. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property.

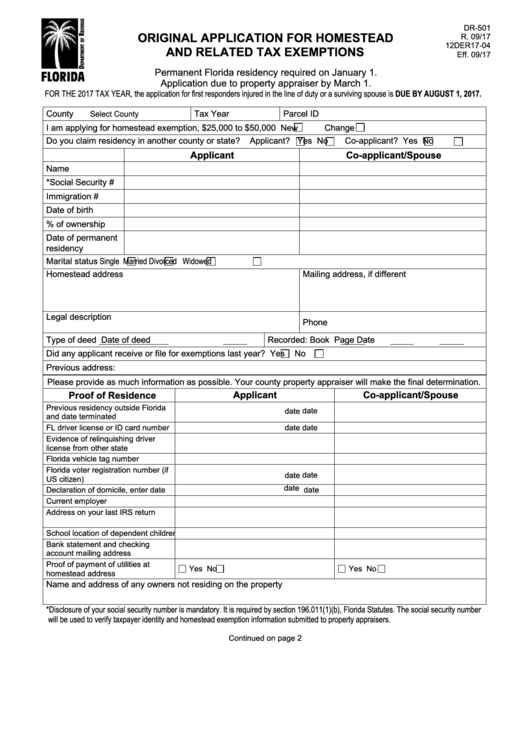

Original application for homestead and related tax exemptions permanent florida residency required on january 1. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. The property appraiser has a duty to put a tax lien on your property if. File the signed application for exemption with the county property appraiser. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,.

Florida Homestead Exemption Application Guide Who is Eligible?

Original application for homestead and related tax exemptions permanent florida residency required on january 1. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. File the signed application for exemption with the county property appraiser. Basic homestead every person who owns and resides on real property in florida on.

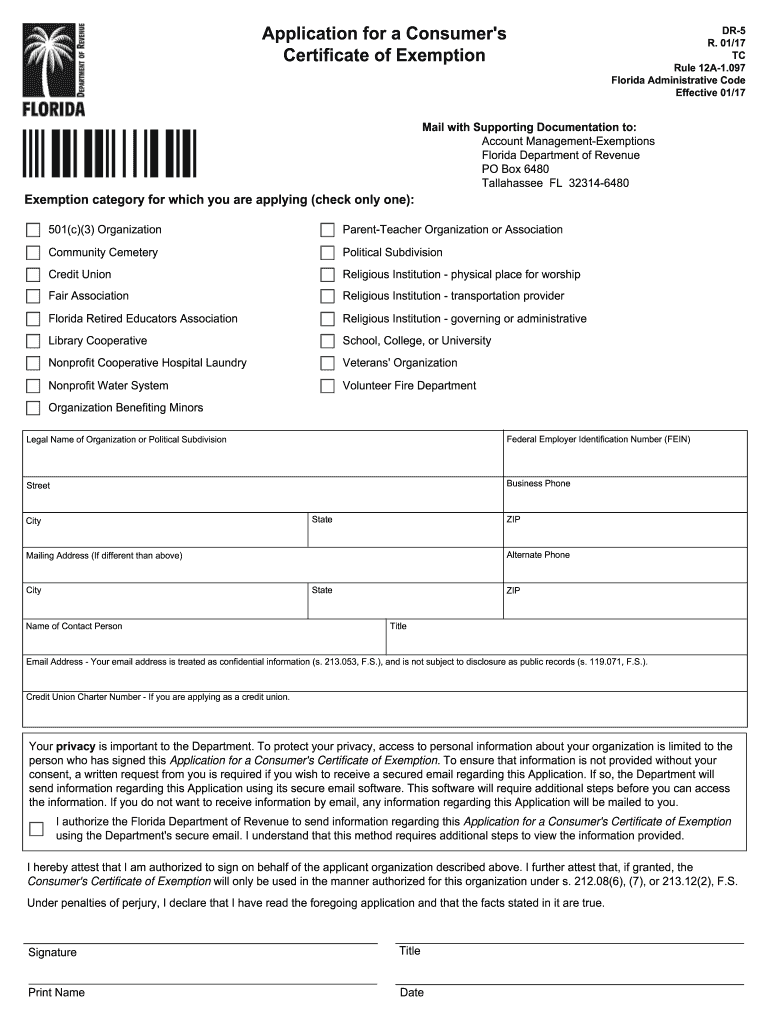

Exemption State of Florida 20172024 Form Fill Out and Sign Printable

If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. File the signed application for exemption with the county property appraiser. 11 rows when someone.

Fillable Form Dr501 Original Application For Homestead And Related

Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. The property appraiser has a duty to put a tax lien on.

MustKnow Facts About Florida Homestead Exemptions Lakeland Real Estate

If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. 11 rows when someone owns property and makes it his or her permanent residence or.

Buying a new home in Orlando? Save Money File Homestead Exemption

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. If you have applied for a new homestead exemption and are entitled to transfer.

Homestead Exemption Form, Don't to File in 2021! Christy Buck Team

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. 11 rows when someone owns property and makes it his or her permanent residence or the permanent.

Homestead Waiver Form Edit & Share airSlate SignNow

The property appraiser has a duty to put a tax lien on your property if. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his.

2024 Homestead Exemption Deadline Berny Kissie

If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. The property appraiser has a duty to put a tax lien on.

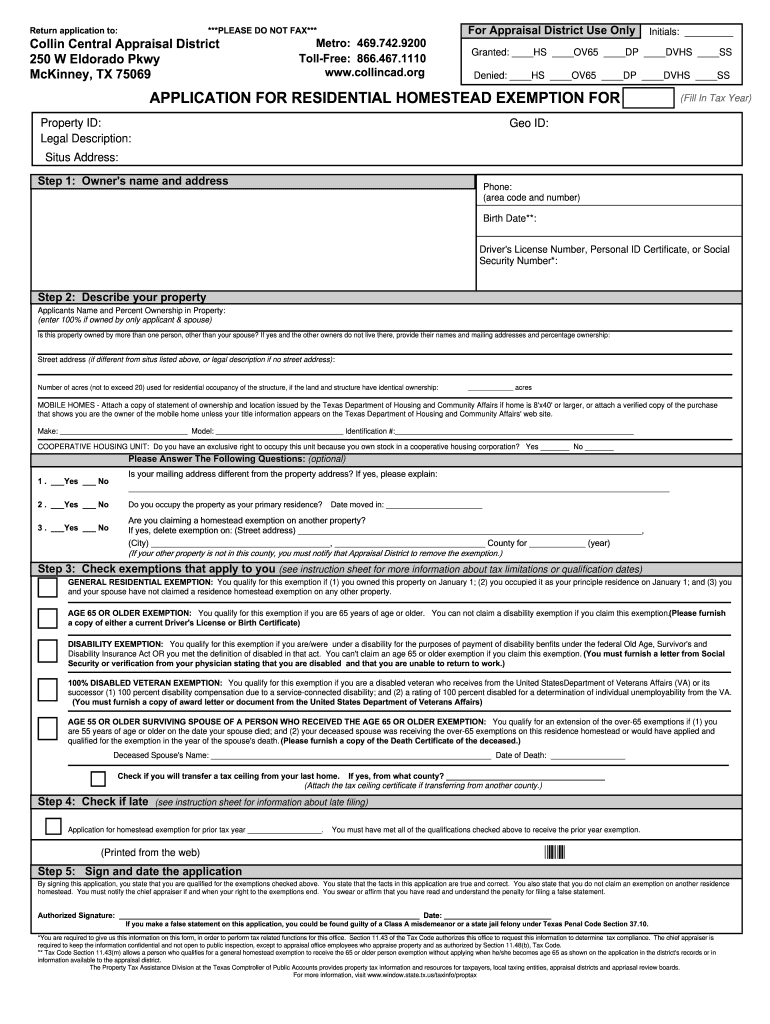

2024 Application For Residential Homestead Exemption Klara Michell

File the signed application for exemption with the county property appraiser. The property appraiser has a duty to put a tax lien on your property if. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. If you have applied for a new homestead exemption and are.

Homestead related tax exemptions Fill out & sign online DocHub

The property appraiser has a duty to put a tax lien on your property if. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the.

If You Have Applied For A New Homestead Exemption And Are Entitled To Transfer A Homestead Assessment Difference From A.

11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Original application for homestead and related tax exemptions permanent florida residency required on january 1. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property.

File The Signed Application For Exemption With The County Property Appraiser.

Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. The property appraiser has a duty to put a tax lien on your property if.