Interest Rate Formula Math

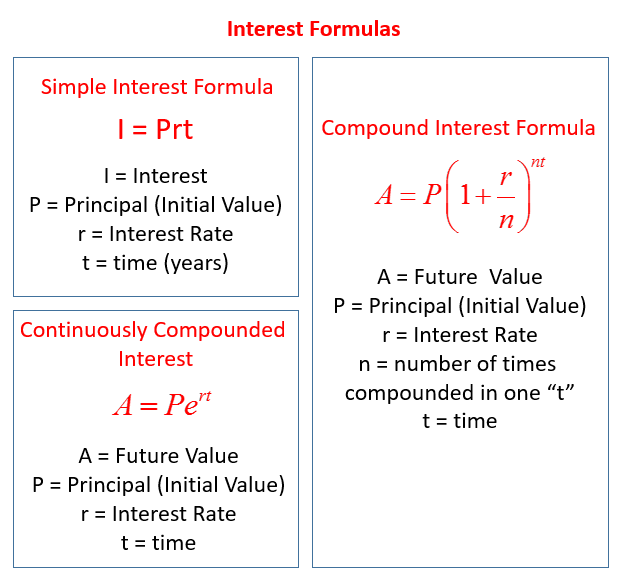

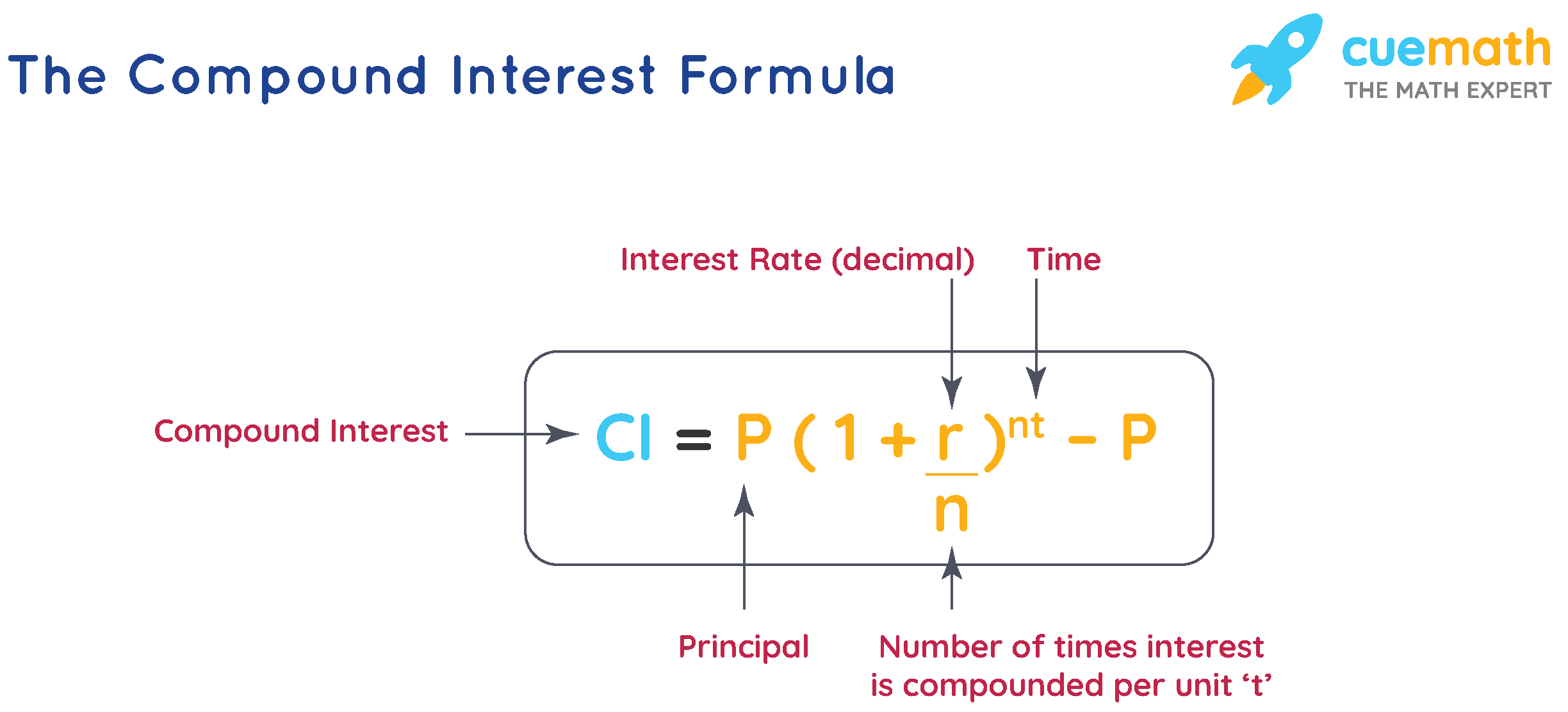

Interest Rate Formula Math - The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. Understanding what interest rate is needed to achieve a future savings goal. So, the basic formula for compound interest is: Determining the interest rate on a single payment loan. With that we can work out the future value fv when we know the present value pv, the.

So, the basic formula for compound interest is: With that we can work out the future value fv when we know the present value pv, the. The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. Understanding what interest rate is needed to achieve a future savings goal. Determining the interest rate on a single payment loan.

Understanding what interest rate is needed to achieve a future savings goal. With that we can work out the future value fv when we know the present value pv, the. Determining the interest rate on a single payment loan. So, the basic formula for compound interest is: The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank.

How To Calculate Compound Interest Rate Formula Math Formulas Images

So, the basic formula for compound interest is: Understanding what interest rate is needed to achieve a future savings goal. The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. With that we can work out the future value fv when we know the present value.

Simple Interest Formula (examples, solutions, videos)

The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. So, the basic formula for compound interest is: Understanding what interest rate is needed to achieve a future savings goal. With that we can work out the future value fv when we know the present value.

How To Check Interest Rates Battlepriority6

With that we can work out the future value fv when we know the present value pv, the. Understanding what interest rate is needed to achieve a future savings goal. So, the basic formula for compound interest is: The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender.

Compound Interest IGCSE at Mathematics Realm

With that we can work out the future value fv when we know the present value pv, the. The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. So, the basic formula for compound interest is: Understanding what interest rate is needed to achieve a future.

Business Mathematics Commercial Mathematics Formulae & Definitions

The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. With that we can work out the future value fv when we know the present value pv, the. So, the basic formula for compound interest is: Understanding what interest rate is needed to achieve a future.

Interest Rate Formula, Definition and Solved Examples

With that we can work out the future value fv when we know the present value pv, the. So, the basic formula for compound interest is: The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. Determining the interest rate on a single payment loan. Understanding.

Calculate Simple Interest Principal, Rate, or Time

Understanding what interest rate is needed to achieve a future savings goal. So, the basic formula for compound interest is: The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. With that we can work out the future value fv when we know the present value.

Interest Formula What is Interest Formula? Examples

The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. So, the basic formula for compound interest is: With that we can work out the future value fv when we know the present value pv, the. Determining the interest rate on a single payment loan. Understanding.

Calculate Simple Interest Principal, Rate, or Time

The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. With that we can work out the future value fv when we know the present value pv, the. Understanding what interest rate is needed to achieve a future savings goal. Determining the interest rate on a.

Daily Compound Interest Tables Calculator

With that we can work out the future value fv when we know the present value pv, the. Determining the interest rate on a single payment loan. The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. Understanding what interest rate is needed to achieve a.

So, The Basic Formula For Compound Interest Is:

Determining the interest rate on a single payment loan. The interest rate formula helps in getting the interest rate, which is the percentage of the principal amount, charged by the lender or bank. With that we can work out the future value fv when we know the present value pv, the. Understanding what interest rate is needed to achieve a future savings goal.

:max_bytes(150000):strip_icc()/Interest-formula_1-589b87ac3df78c47589b0e25.jpg)

:max_bytes(150000):strip_icc()/Interest-formula_7-589b92f45f9b58819cafefaf.jpg)