Irs Form 4180

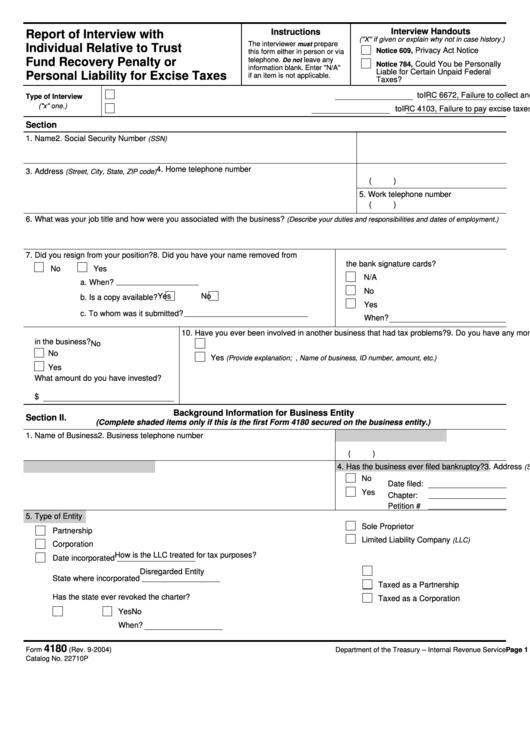

Irs Form 4180 - State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties. Determine financial policy for the. Form 4180 is the form to be used for conducting tfrp interviews. What is the purpose of a form 4180 interview? It is intended to be used as a record of a personal interview with a potentially responsible person. The agent is trying to determine if you are responsible, but the agent is also trying to. Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests and quick and prompt assessment actions. The responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise tax and supplied all. The purpose of this interview is to figure out who is responsible.

State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties. The purpose of this interview is to figure out who is responsible. Form 4180 is the form to be used for conducting tfrp interviews. Determine financial policy for the. The agent is trying to determine if you are responsible, but the agent is also trying to. Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests and quick and prompt assessment actions. What is the purpose of a form 4180 interview? It is intended to be used as a record of a personal interview with a potentially responsible person. The responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise tax and supplied all.

Form 4180 is the form to be used for conducting tfrp interviews. The purpose of this interview is to figure out who is responsible. What is the purpose of a form 4180 interview? Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests and quick and prompt assessment actions. It is intended to be used as a record of a personal interview with a potentially responsible person. Determine financial policy for the. State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties. The responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise tax and supplied all. The agent is trying to determine if you are responsible, but the agent is also trying to.

2007 Form IRS 4180 Fill Online, Printable, Fillable, Blank pdfFiller

The purpose of this interview is to figure out who is responsible. State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties. Determine financial policy for the. Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests.

Are You Ready for Your IRS Form 4180 Trust Fund Interview? Blog

What is the purpose of a form 4180 interview? The responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise tax and supplied all. Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests and quick and prompt.

Fillable Form 4180 Report Of Interview With Individual Relative To

The responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise tax and supplied all. Determine financial policy for the. State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties. Form.

Irs Form 4180 Fillable Printable Forms Free Online

State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties. Determine financial policy for the. It is intended to be used as a record of a personal interview with a potentially responsible person. The responsible person must have completed a form 4180, report of interview.

IRS Form 4180 The Trust Fund Recovery Penalty Interview

State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties. It is intended to be used as a record of a personal interview with a potentially responsible person. Form 4180 is the form to be used for conducting tfrp interviews. Provides guidance to collection employees.

Irs Form 4180 Fillable Printable Forms Free Online

Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests and quick and prompt assessment actions. What is the purpose of a form 4180 interview? The responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise tax and.

Irs Form 4180 Fillable and Editable PDF Template

Determine financial policy for the. The agent is trying to determine if you are responsible, but the agent is also trying to. Form 4180 is the form to be used for conducting tfrp interviews. The purpose of this interview is to figure out who is responsible. It is intended to be used as a record of a personal interview with.

IRS Form 4180 Interview Trust Fund Recovery Penalty Interview

Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests and quick and prompt assessment actions. The responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise tax and supplied all. The purpose of this interview is to.

Preparing For A Trust Fund Recovery Penalty Form 4180 Interview

The agent is trying to determine if you are responsible, but the agent is also trying to. Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests and quick and prompt assessment actions. Determine financial policy for the. What is the purpose of a form 4180 interview? State whether you performed any.

TFRP Penalty Interview IRS Form 4180

Provides guidance to collection employees for the processing of the trust fund recovery penalty (tfrp) cases, including protests and quick and prompt assessment actions. The purpose of this interview is to figure out who is responsible. Form 4180 is the form to be used for conducting tfrp interviews. Determine financial policy for the. The agent is trying to determine if.

Provides Guidance To Collection Employees For The Processing Of The Trust Fund Recovery Penalty (Tfrp) Cases, Including Protests And Quick And Prompt Assessment Actions.

What is the purpose of a form 4180 interview? Determine financial policy for the. It is intended to be used as a record of a personal interview with a potentially responsible person. State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties.

The Purpose Of This Interview Is To Figure Out Who Is Responsible.

The responsible person must have completed a form 4180, report of interview with individual relative to trust fund recovery penalty or personal liability for excise tax and supplied all. Form 4180 is the form to be used for conducting tfrp interviews. The agent is trying to determine if you are responsible, but the agent is also trying to.