Md Withholding Tax Form

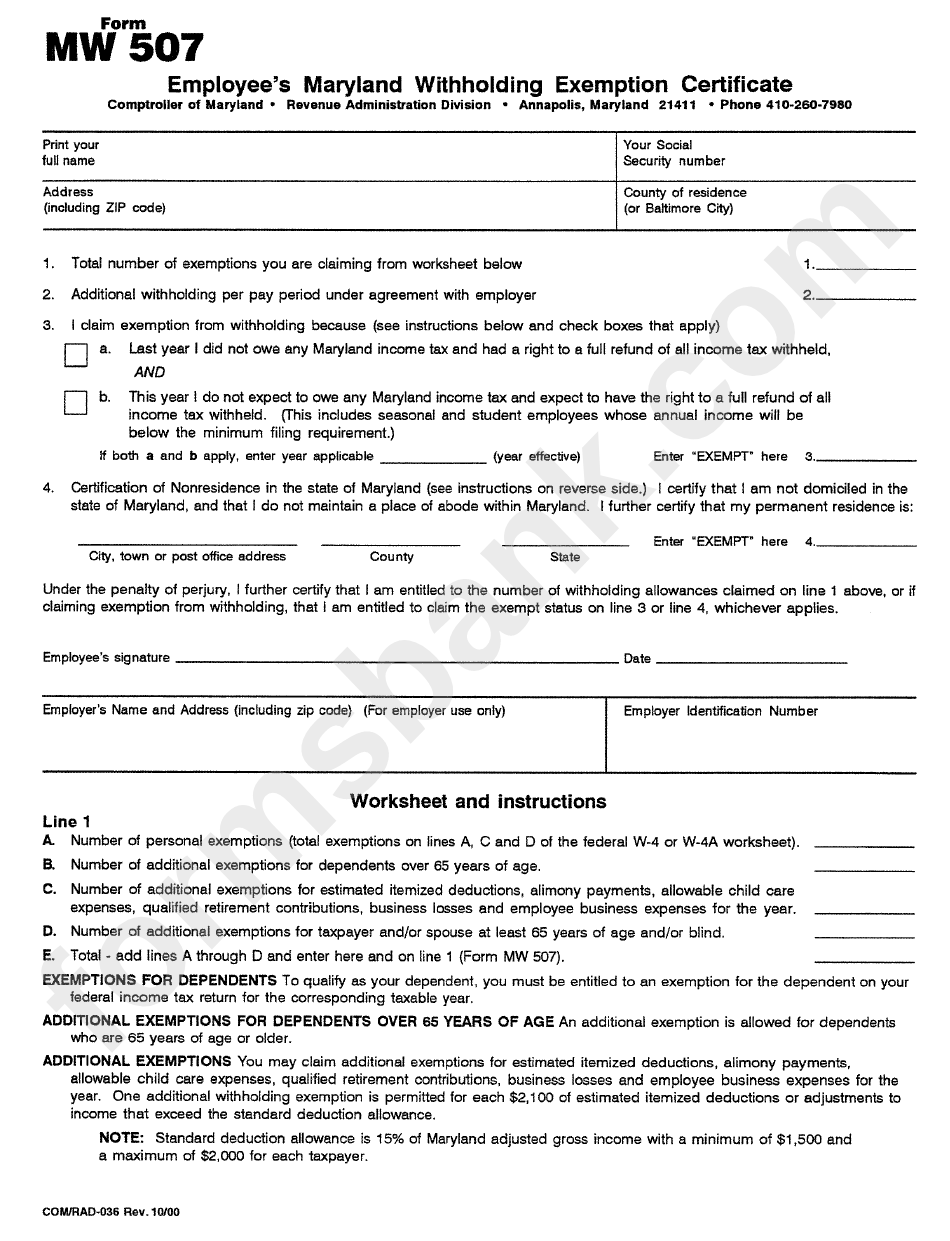

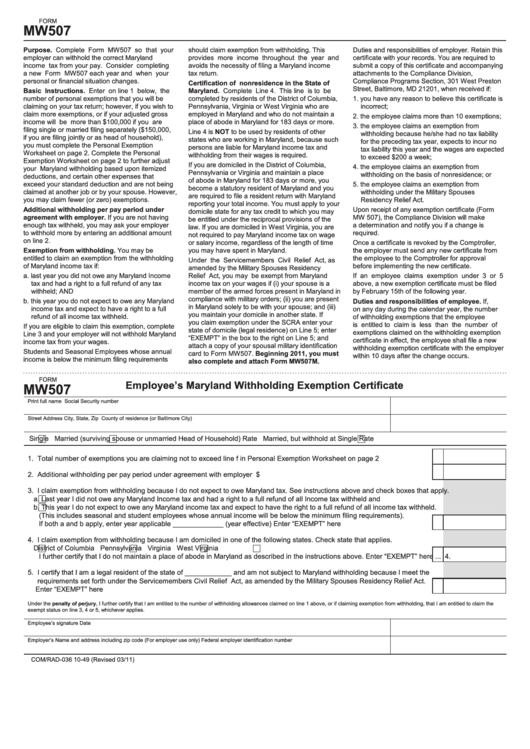

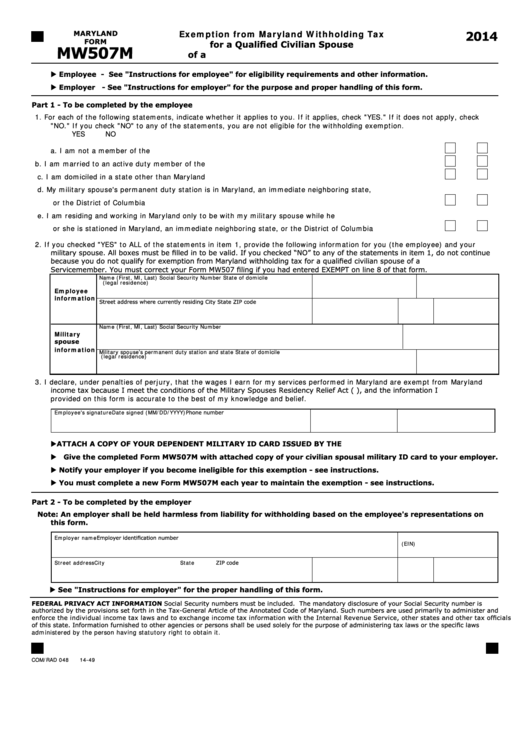

Md Withholding Tax Form - You will need to access the current maryland employer. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. Consider completing a new form.

Consider completing a new form. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. You will need to access the current maryland employer. The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld.

You will need to access the current maryland employer. The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. Consider completing a new form. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement.

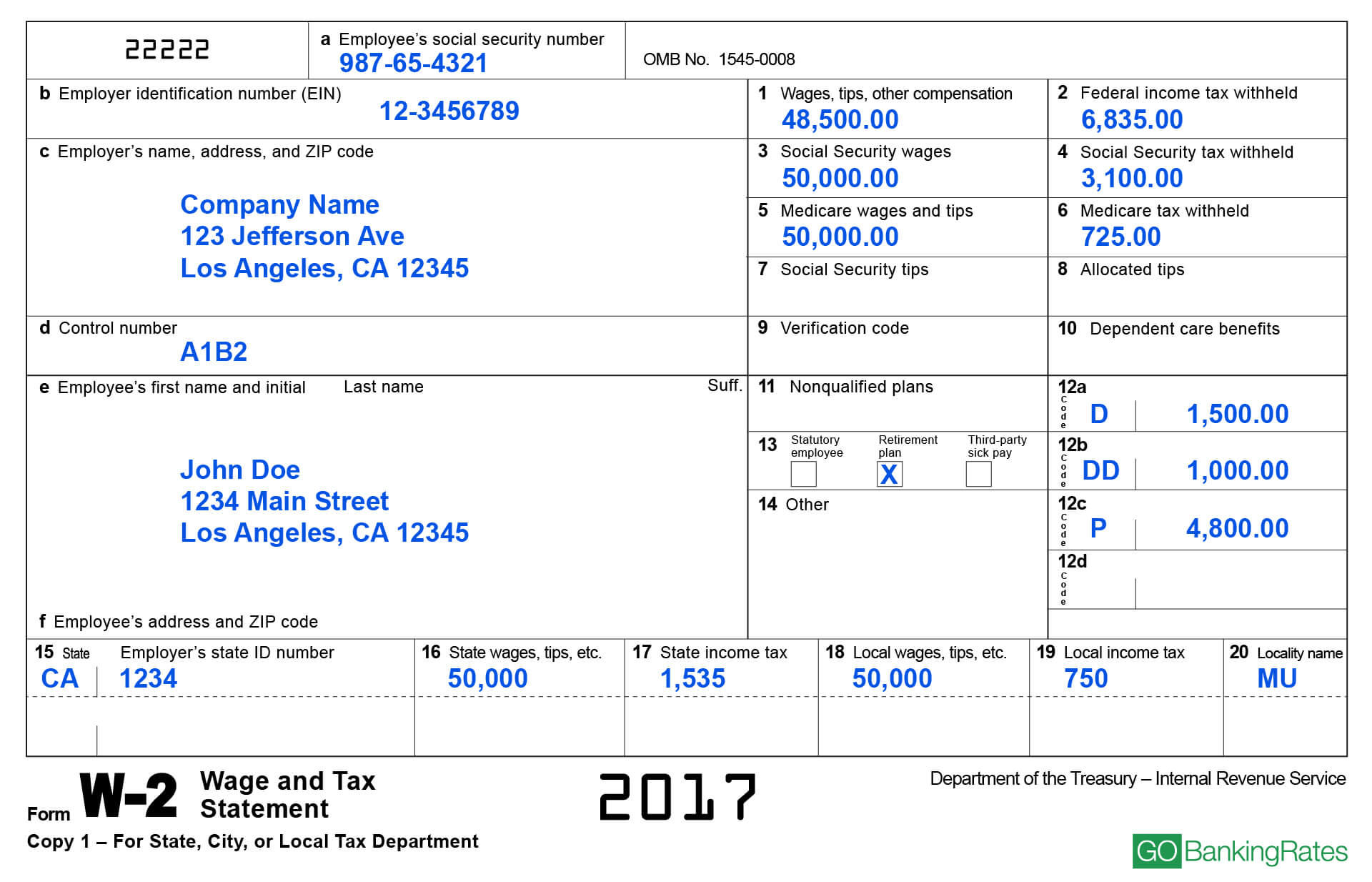

Maryland W4 Form 2024 Dayle Annelise

Options are available on the new maryland tax connect portal at mdtaxconnect.gov. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Consider completing a new form. This year i do not.

Maryland Tax Withholding Form 2024 Lian Sheena

You will need to access the current maryland employer. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Maryland income tax.

WITHHOLDING TAX IN NIGERIA LexPraxis Legal Solicitors

Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. You will need to access the.

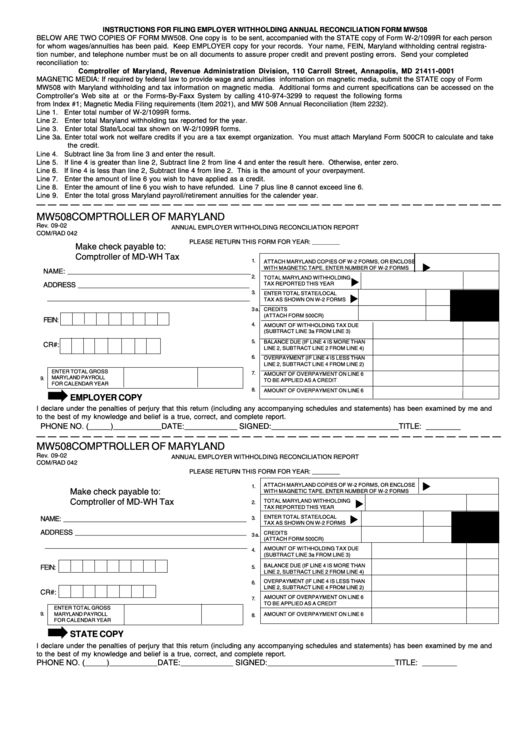

Maryland State Tax Employer Withholding Form

Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. You will need to access the current maryland employer. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Annuity and sick pay request for maryland income tax withholding form used by.

State Withholding Tax Form 2023 Printable Forms Free Online

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. This.

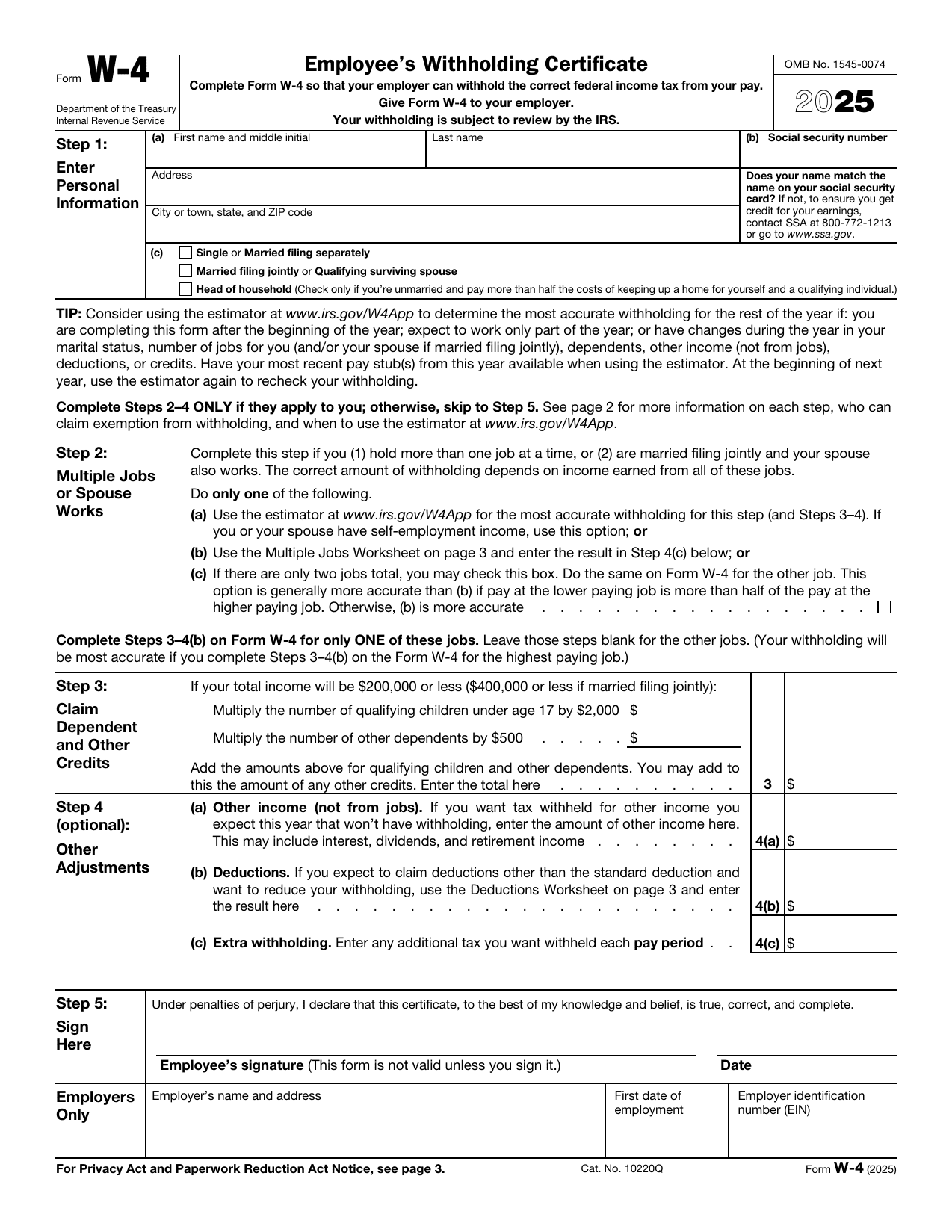

Maryland State Tax Withholding Form

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. You will need to access the current maryland employer. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. The law requires that you complete an employee’s withholding allowance certificate so that.

Maryland Tax Withholding Form 2024 Lian Sheena

Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. Consider completing a new form. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Complete form mw507 so that your employer can withhold the correct maryland income.

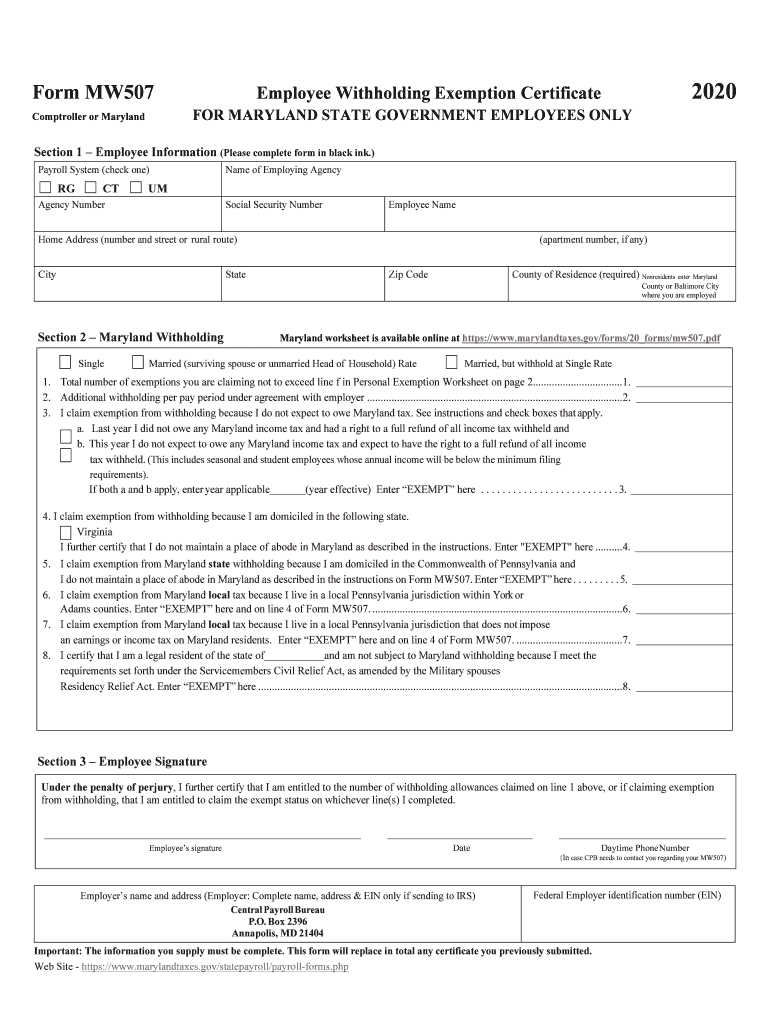

Form Mw507 Employee's Maryland Withholding Exemption Certificate

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Consider completing a new form. You will need to access the current maryland employer. Options are available on the new maryland tax.

MD MW506R 2019 Fill out Tax Template Online US Legal Forms

This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld. Consider completing a new form. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. You will need to access the current maryland employer. Options are.

Maryland Withholding Tax Form

Annuity and sick pay request for maryland income tax withholding form used by recipients of annuity, sick pay or retirement distribution. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. You will need to access the.

Annuity And Sick Pay Request For Maryland Income Tax Withholding Form Used By Recipients Of Annuity, Sick Pay Or Retirement Distribution.

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Consider completing a new form. Options are available on the new maryland tax connect portal at mdtaxconnect.gov. Maryland income tax withholding for annuity, sick pay and retirement distributions form used by recipients of annuity, sick pay or retirement.

You Will Need To Access The Current Maryland Employer.

The law requires that you complete an employee’s withholding allowance certificate so that your employer, the state of maryland, can withhold. This year i do not expect to owe any maryland income tax and expect to have the right to a full refund of all income tax withheld.