Ubereats Tax Form

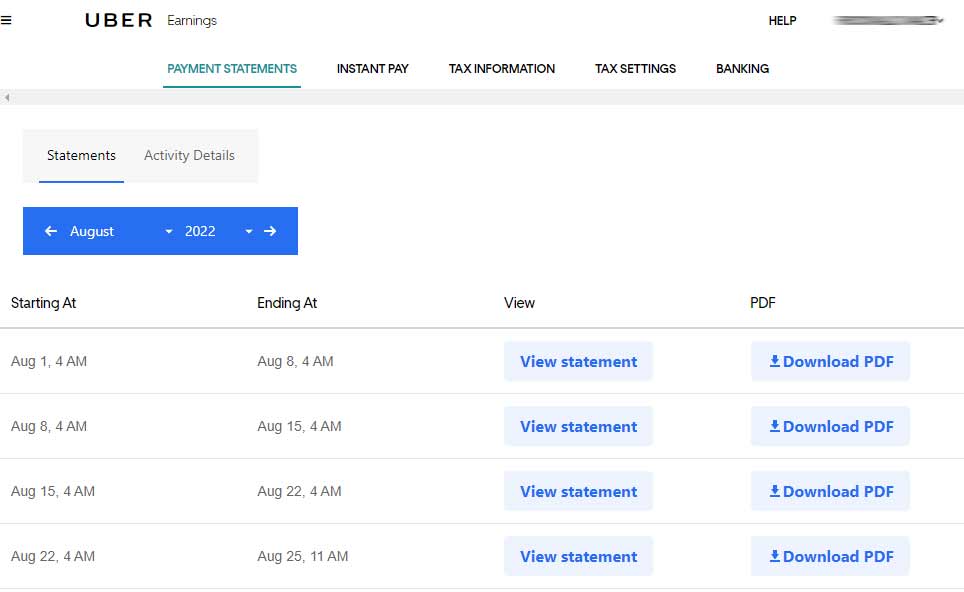

Ubereats Tax Form - All annual tax documents listed below. Log in to drivers.uber.com and click the “tax information” tab. This form is for drivers who. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. As a uber independent contractor, you may receive one or both of the following tax forms: Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual. If you also opted in to receive your tax forms by mail, tax documents. All tax documents will be available electronically via the uber eats manager. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. Click “download” next to your tax forms when they are available.

All annual tax documents listed below. If you also opted in to receive your tax forms by mail, tax documents. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual. All tax documents will be available electronically via the uber eats manager. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. Click “download” next to your tax forms when they are available. This form is for drivers who. Log in to drivers.uber.com and click the “tax information” tab. As a uber independent contractor, you may receive one or both of the following tax forms:

As a uber independent contractor, you may receive one or both of the following tax forms: I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. All annual tax documents listed below. If you also opted in to receive your tax forms by mail, tax documents. This form is for drivers who. Click “download” next to your tax forms when they are available. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. Log in to drivers.uber.com and click the “tax information” tab. All tax documents will be available electronically via the uber eats manager. Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual.

Uber Eats Pay Stubs, Earning Statements, Employment Verification

As a uber independent contractor, you may receive one or both of the following tax forms: All tax documents will be available electronically via the uber eats manager. Click “download” next to your tax forms when they are available. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. Log.

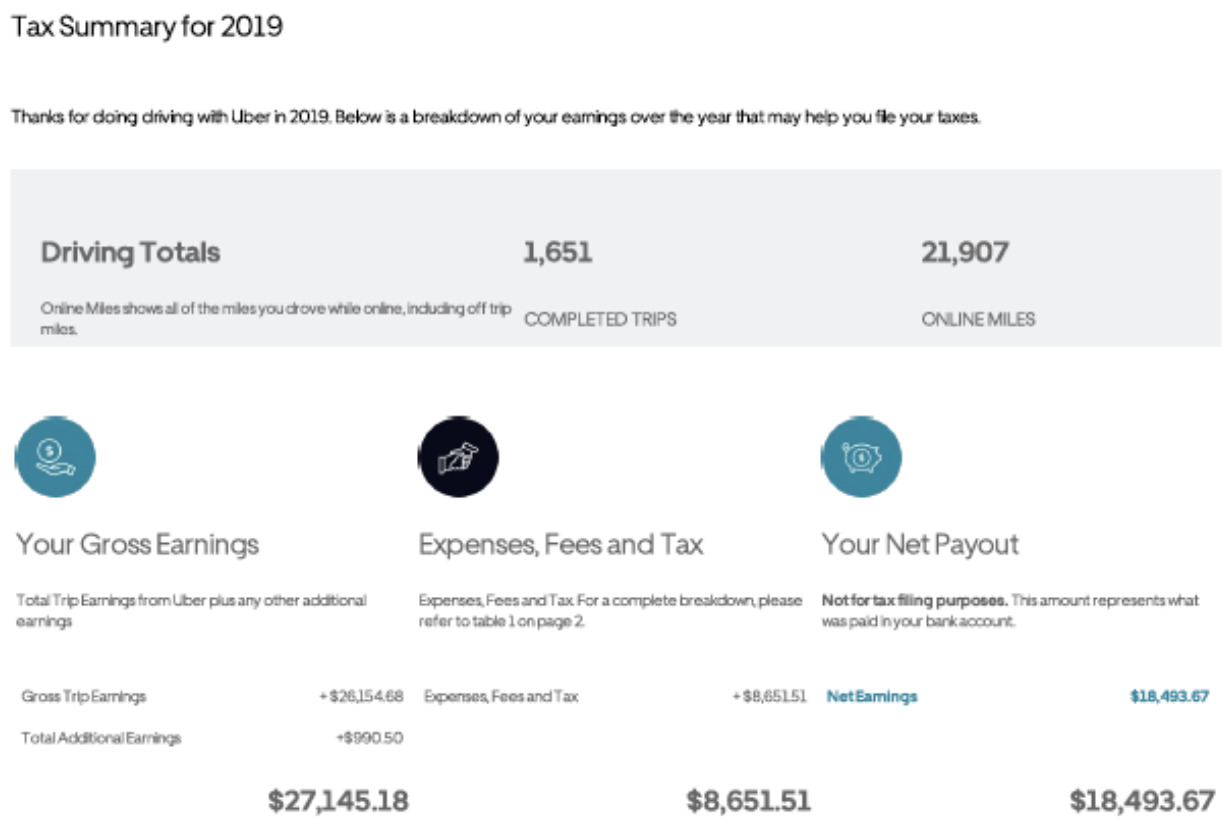

Uber Drivers How To Calculate Your Taxes Using TurboTax

If you also opted in to receive your tax forms by mail, tax documents. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings..

Tax form hires stock photography and images Alamy

This form is for drivers who. As a uber independent contractor, you may receive one or both of the following tax forms: All tax documents will be available electronically via the uber eats manager. If you also opted in to receive your tax forms by mail, tax documents. All annual tax documents listed below.

How Do Food Delivery Couriers Pay Taxes? Get It Back

Log in to drivers.uber.com and click the “tax information” tab. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. All annual tax documents listed below. As a uber independent contractor, you may receive one or both of the following tax forms: All tax documents will be available electronically via.

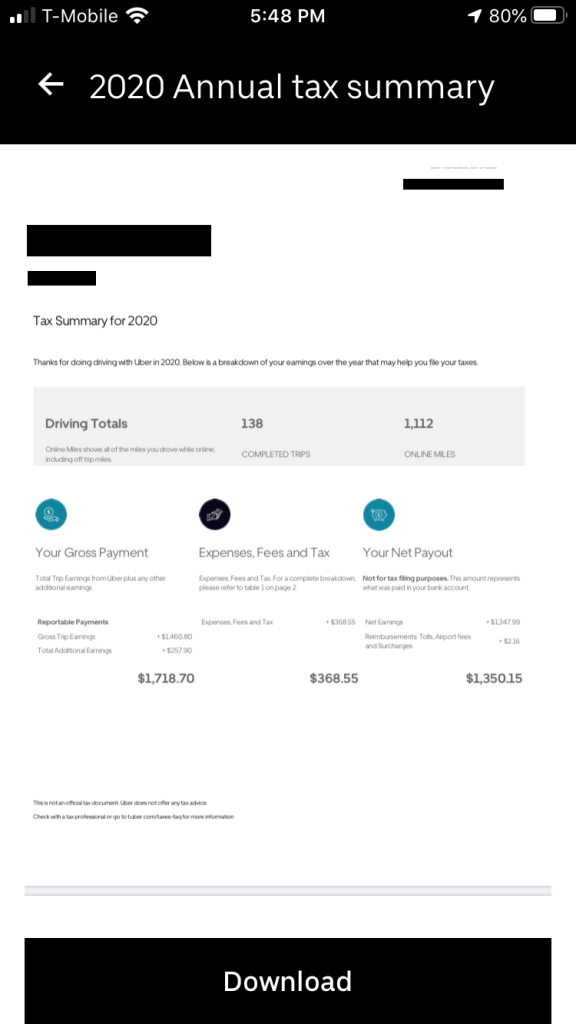

Ok, since I didn't get a 1099 form, where would I submit this in my tax

To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. As a uber independent contractor, you may receive one or both of the following tax forms: If you also opted in to receive your tax forms by mail, tax documents. Click “download” next to your tax forms when they are.

A complete guide to taxes for Postmates,Doordash, UberEats drivers

To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. As a uber independent contractor, you may receive one or both of the following tax forms: Since you are now a subcontractor, all of your income and expenses will be reported on a schedule c when filing your individual. If.

Tax Form For Seniors 2023 Printable Forms Free Online

To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. All tax documents will be available electronically via the uber eats manager. If you also opted in to receive your tax forms by mail, tax documents. This form is for drivers who. Log in to drivers.uber.com and click the “tax.

UberEats Business Model & Revenue Model Guide] by Sarasameera

To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings are below the income threshold and that they will. As a uber independent contractor, you may receive one or both of the following.

Discover all that there is to know about paying taxes when driving for

Click “download” next to your tax forms when they are available. As a uber independent contractor, you may receive one or both of the following tax forms: This form is for drivers who. Log in to drivers.uber.com and click the “tax information” tab. I've made well over $600 (the threshold) with uber, yet the mobile app tells me my earnings.

how to fill tax form in adsense 2023 us tax form kaise bhare 2023

All tax documents will be available electronically via the uber eats manager. All annual tax documents listed below. If you also opted in to receive your tax forms by mail, tax documents. Log in to drivers.uber.com and click the “tax information” tab. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your.

Since You Are Now A Subcontractor, All Of Your Income And Expenses Will Be Reported On A Schedule C When Filing Your Individual.

All tax documents will be available electronically via the uber eats manager. This form is for drivers who. To file your tax return, you’ll need to use your 1099 forms and tax summaries, tailored to your uber earnings. Click “download” next to your tax forms when they are available.

I've Made Well Over $600 (The Threshold) With Uber, Yet The Mobile App Tells Me My Earnings Are Below The Income Threshold And That They Will.

As a uber independent contractor, you may receive one or both of the following tax forms: All annual tax documents listed below. Log in to drivers.uber.com and click the “tax information” tab. If you also opted in to receive your tax forms by mail, tax documents.

![UberEats Business Model & Revenue Model Guide] by Sarasameera](https://image.isu.pub/221221072641-5bf1d56009da05af3b8ad5d5ce8e0554/jpg/page_1.jpg)