What Is Ventura County Sales Tax

What Is Ventura County Sales Tax - The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. There are a total of 466. The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. This is the total of state, county, and city sales tax rates. The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. While many other states allow counties and other localities to. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The ventura county, california sales tax is 7.25%, the same as the california state sales tax.

Look up the current sales and. This is the total of state, county, and city sales tax rates. While many other states allow counties and other localities to. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. There are a total of 466. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax.

The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. While many other states allow counties and other localities to. This is the total of state, county, and city sales tax rates. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The ventura county, california sales tax is 7.25%, the same as the california state sales tax. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax. The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. There are a total of 466. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage.

Ventura's sales tax measure includes an oversight board

The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The minimum combined 2024 sales tax rate for ventura county,.

Ventura's sales tax measure includes an oversight board

547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. While many other states allow counties and other localities to..

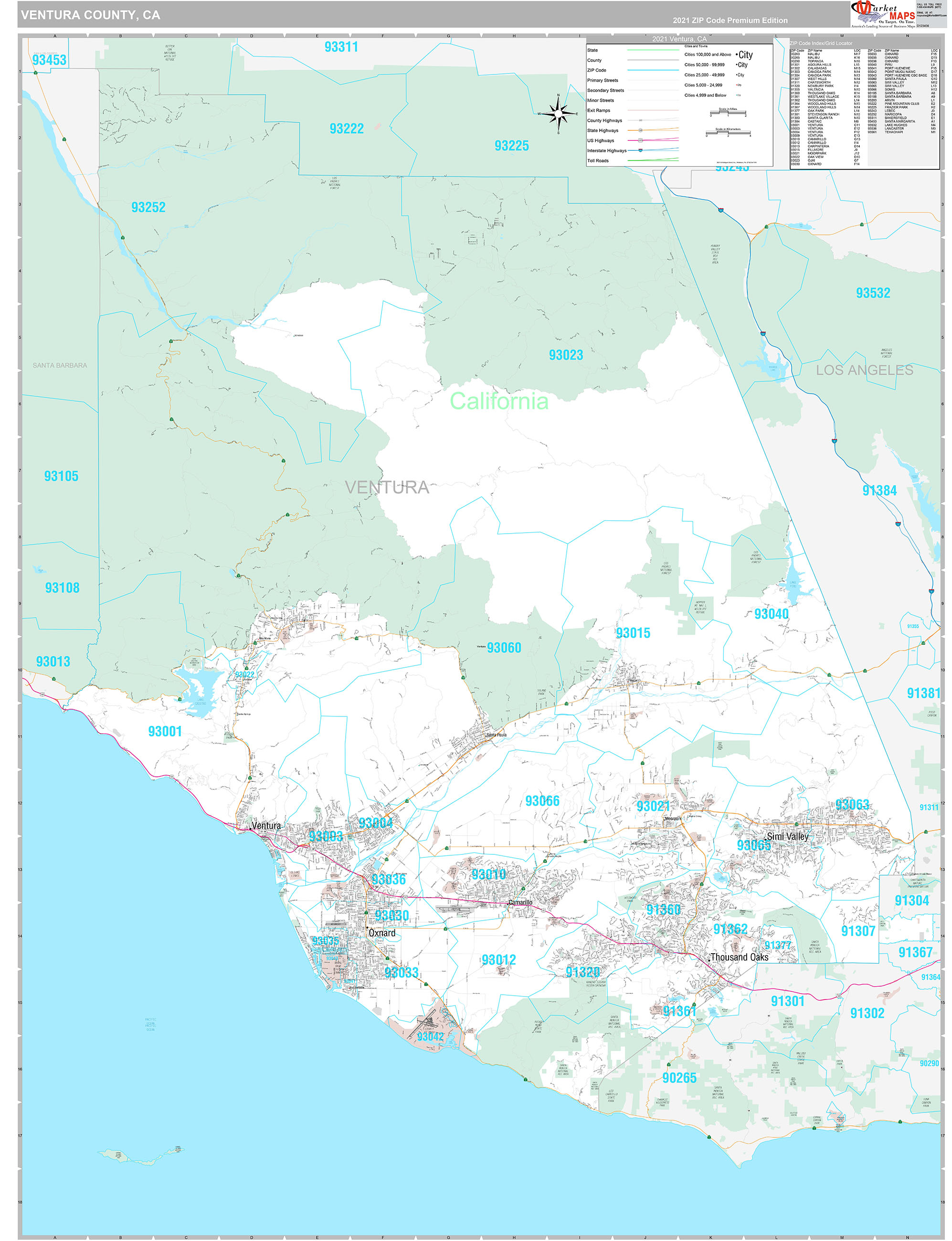

Ventura County, CA Wall Map Premium Style by MarketMAPS MapSales

This is the total of state, county, and city sales tax rates. The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. While many other states allow counties and other localities to. The 7.75% sales tax rate in ventura consists of 6% california state.

Ventura County Property Tax Due Dates PRORFETY

The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax. This is the total of state, county, and.

Printable Sales Tax Chart

1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. There are a total of 466. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. The ventura county, california.

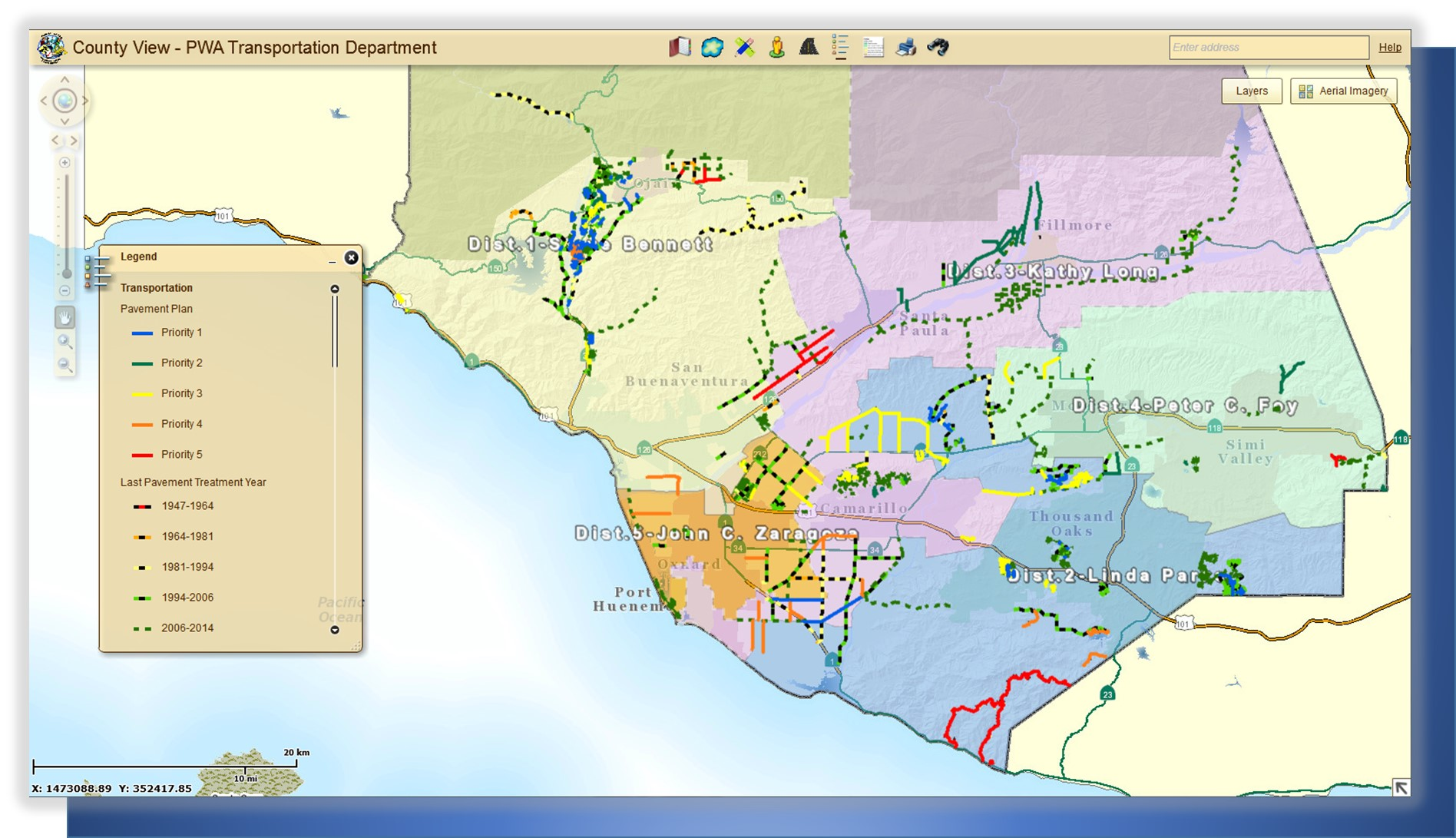

Ventura County Works Workforce Development Board of Ventura County

Look up the current sales and. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax. While many other states allow counties and other localities to. This is the total of state, county, and city sales tax rates. The minimum combined 2024 sales tax.

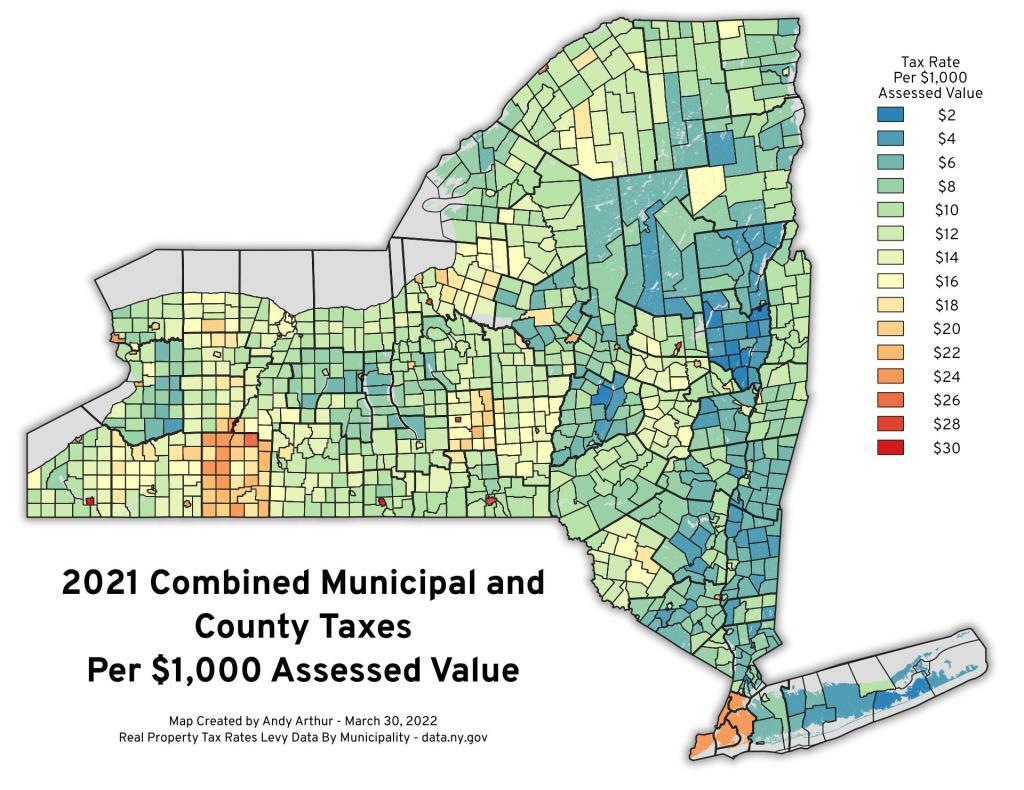

Thematic Map 2021 Combined Municipal and County Taxes Per 1,000

The ventura county, california sales tax is 7.25%, the same as the california state sales tax. This is the total of state, county, and city sales tax rates. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. There are a total of 466. The local.

California Woman Who Stabbed Boyfriend 108 Times Sentenced to Probation

The ventura county, california sales tax is 7.25%, the same as the california state sales tax. This is the total of state, county, and city sales tax rates. While many other states allow counties and other localities to. The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5%.

VENTURA COUNTY CA TAX DEED AUCTION REVIEW! 627K HOME OPENS AT 38K YouTube

1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. The 7.75% sales tax rate in ventura consists of 6%.

Local transportation sales tax measure likely won't be on 2020 ballot

The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. The ventura county, california sales tax is 7.25%, the same as the california state sales tax. 547 rows for a list of your current and historical rates, go to the california city & county.

The 7.75% Sales Tax Rate In Ventura Consists Of 6% California State Sales Tax, 0.25% Ventura County Sales Tax, 0.5% Ventura Tax And 1% Special Tax.

547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The ventura county, california sales tax is 7.25%, the same as the california state sales tax. The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%.

There Are A Total Of 466.

The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. This is the total of state, county, and city sales tax rates. Look up the current sales and. While many other states allow counties and other localities to.